[ad_1]

The EUR/USD exchange rate’s recovery from early March lows stalled last week, causing the single European currency to partially reverse some of its gains ahead of the weekend and leave it at risk of a deeper setback over the coming days. The EUR/USD currency pair fell to the support level of 1.0944 at the beginning of this week’s trading, and settled around the level of 1.0985 at the time of writing the analysis, amid strong and continuous control of the bears on the trend. The Euro fell after a slight last minute rise in crude oil and gas prices seemed to weigh on the Euro just as the US Dollar gained momentum on a firmer basis against many of the major currencies.

The EUR/USD has proven vulnerable to sharp hikes in energy prices, which could be seen again this week if the Kremlin pushes ahead in an effort to force “unfriendly countries” to pay for Russian gas in rubles rather than in euros and dollars. “This sent gas prices up sharply after an extended downtrend and weighed on the global risk sentiment,” says Chris Turner, market analyst at ING Bank. The analyst added by saying that the euro-dollar tends to 1.0800-1.0900 in the coming weeks.

The Kremlin’s plan puts European countries between a rock and a hard place because, if implemented, it would undermine the impact of international sanctions imposed on Moscow over its war in Ukraine, while refusing to pay in rubles could harm European gas supplies. The latter could represent an upward risk to energy prices and an almost certain weight around the ankles of the euro-dollar rate, although both will also be sensitive to the outcome of this week’s negotiations between Russia and Ukraine, which are likely to be an upward risk for the euro.

Talks resume in Turkey and run through Wednesday and any further suggestions on making progress toward a ceasefire or conflict resolution are likely to be supportive of euro exchange rates in almost all areas, and vice versa. Commenting on this, Derek Halpini, Global Markets Analyst at MUFG warns, “Despite the continued talk of progress in the peace talks between Russia and Ukraine, there was no clear breakout.” Therefore, the EUR/USD pair may head lower towards 1.07 in the coming weeks. .

While the positive noise from negotiations between Russia and Ukraine is likely to be positive for the euro, the euro and dollar rate will also have to contend with US interest rate expectations, which still pose upside risks to the dollar. This comes after Chairman Jerome Powell told the National Association of Business Economics conference last Tuesday that US interest rates could be raised in 0.50% increments on more than one occasion, and at a faster pace than financial markets have been expecting so far for the coming months.

Overall, the risk of the Fed moving faster as a burden on the euro could grow this week if Thursday’s reading of the core February PCE price index, the Fed’s preferred measure of inflation, shows domestic inflation gaining momentum again last month. .

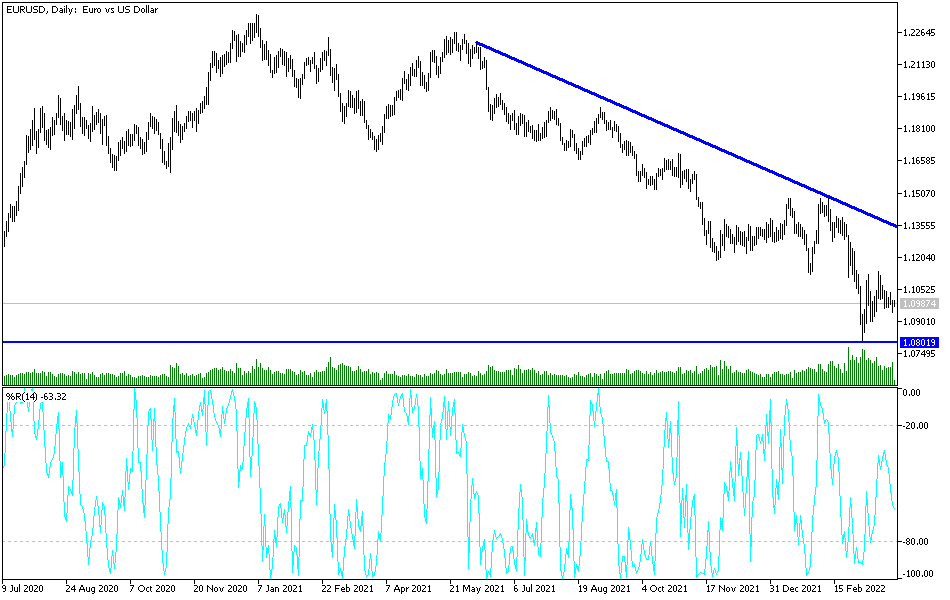

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair. The general trend is still bearish and stability below the 1.1000 level motivates the bears to move further down. The next most important support levels may be 1.0925 and the psychological support 1.0800 is still in the bears’ range As long as the Russian war exists and its negative consequences. On the upside, the most important resistance levels for the pair may now be 1.1130 and 1.1220, respectively. I still prefer to sell EURUSD from every bullish level.

The pair will interact today with the announcement of the German GFK consumer climate index, and from the United States, the number of job opportunities and the US consumer confidence reading.

[ad_2]