[ad_1]

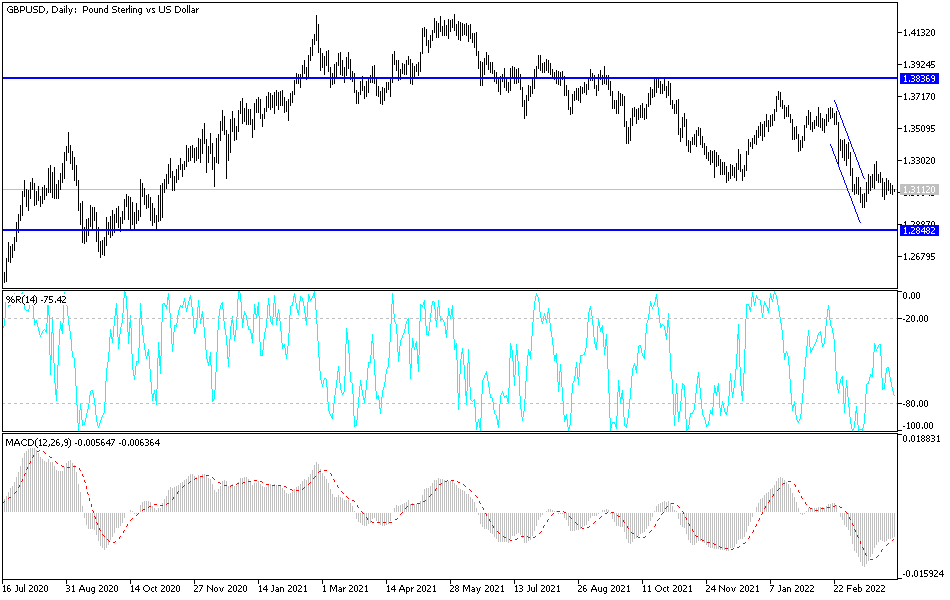

During recent trading sessions, the price of the GBP/USD currency pair is moving in narrow ranges, amid bearish momentum, between the support level of 1.3082 and the resistance level of 1.3180. It settled around the level of 1.3115 at the time of writing the analysis. In general, the GBP/USD exchange rate fell to its lowest level in 18 months due to the strength of the dollar and increasing uncertainty about the Bank of England (BoE) interest rate outlook, which may continue to limit the scope of the sterling recovery over the coming days.

The British pound took a strong loss against the rest of the currencies in the forex market after Bank of England Governor Andrew Bailey suggested that financial markets may be overambitious in their assumptions about interest rate expectations later this year, which explains the cautious bearish performance of the pound.

Overall, recent comments and guidance from the Bank of England have put a growing question mark over expectations that the bank rate will reach 2% by the end of the year, and just as Federal policy makers (Fed) have encouraged financial markets to expect a sharp rise in the Fed funds rate this year and next.

Stubborn increases in US inflation have led the Federal Reserve to increasingly direct investors to expect a full withdrawal of the rate cut from the 1.75% announced in March 2020 and then some on top over the coming quarters. This has seen a shift in financial market pricing to mean a high probability that the Fed will raise the US federal funds rate to 3% by late 2023. This would raise the index to its highest level since before the 2008 financial crisis and would be in addition to the effort the Fed expected to shrink its balance sheet.

For his part, Federal Reserve Chairman Jerome Powell said at the press conference last month, “It will be faster than last time and of course it will be much faster in the cycle than last time.” But it will look familiar. I just want to say that I’m sure there will be a more detailed discussion in the minutes of our meeting which will come out in three weeks, and I expect we’ll pretty much set the standard for what we’re looking at.”

The Fed’s balance sheet plans are likely to be the highlight of this week for the GBP/USD rate and are expected to be announced during Wednesday’s meeting minutes of the March Fed policy meeting.

According to the technical analysis of the pair: Within he bears’ control, the price of the GBP/USD currency pair may head towards the 1.3000 psychological support again if the currency pair settles around the 1.3080 support. Investors are balancing the future of monetary policy tightening by the Bank of England and the US Federal Reserve, which will favor the downside. On the other hand, there will be no strong and sharp bullish trend without moving towards the 1.3335 resistance, according to the performance on the daily chart.

The sterling dollar currency pair will be affected today by the reading of services purchasing managers from both Britain and the United States of America.

[ad_2]