[ad_1]

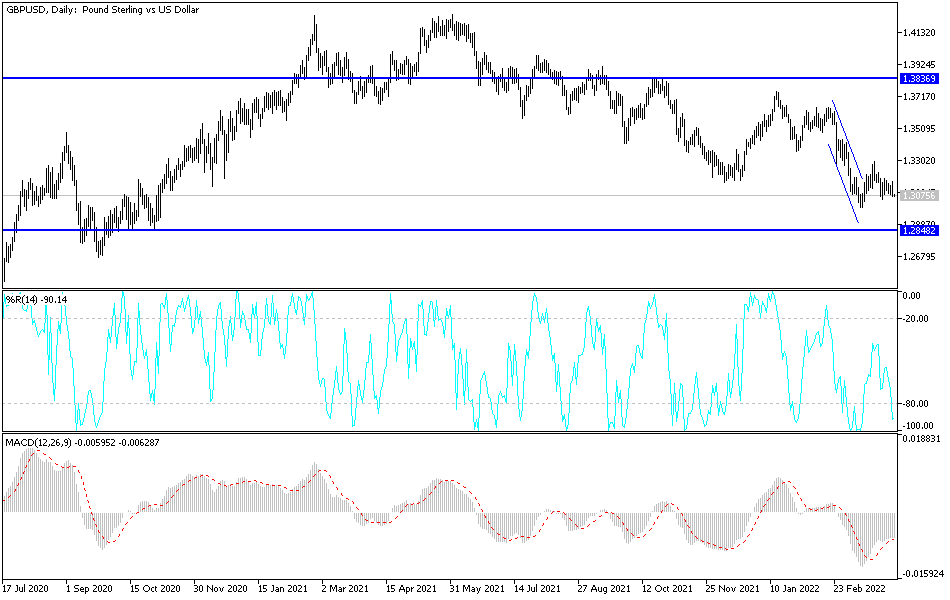

Attempts to withstand against the strength of the US dollar collapsed recently. The price of the GBP/USD currency pair moved towards the support level 1.3068 at the time of writing the closest analysis to breaching the psychological support 1.3000. This confirms the extent and strength of the bears’ control over the performance of the currency pair. In the past, the balance regarding the future of tightening monetary policy of global central banks supported the balance of the performance of the sterling dollar pair. However, the comparison was in favor of the US dollar with the calm tone of tightening on the part of the Bank of England.

Sterling has recently shown more respect for bond yield spreads with some other currencies and in the context of a cautious reversal now creeping into the BoE policy stance, this should probably tell us something about the outlook for other currencies including the US Dollar. The British Pound rose against several major currencies during the opening session of the new week but by Tuesday it was still taking losses against all but the Japanese Yen and the Swiss Franc in the last month and the change in the BoE’s policy stance was a major factor behind these declines.

As the Bank of England warned in March, Governor Andrew Bailey left no doubt in a speech last week that market expectations for bank interest rates have likely reached unsustainable levels for the British economy. Deputy Governor Sir John Cunliffe also spoke in depth on Monday about why the BoE’s upcoming economic outlook in May is more likely to put inflation below target at the other end of the horizon than it was in February.

Much will depend on the course of the conflict and the evolution of sanctions which will intensify and prolong the increase in inflation and put pressure on household incomes.

This is important for significant UK government bond yields, in part because sterling has been rising and falling along with spreads between UK government bond yields and some other cross-currency countries in recent weeks. The relationship may be suggestive of yields where the factors that drive them such as monetary policy are a dominant influence in these exchange rates. This could also indicate something about the outlook for the British pound and a host of other currencies.

The spread rises when the bond market for that currency underperforms the bond market for the other currency, resulting in higher yields compared to the other currency, which is important in the context of the BoE’s evolving policy stance.

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair is closest to testing the 1.3000 psychological support level, which is important for a stronger and continuous control of the bears’ trend. As a result, the currency pair will be subject to more collapse, and therefore the next destination may be 1.2860. On the other hand, the breach of the 1.3335 resistance will be important for a stronger and continuous control of the bulls, otherwise the general trend of the pair will remain bearish. The GBP/USD currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the announcement of the PMI reading of the British construction. The pair will also be affected by the reaction from the announcement of the contents of the minutes of the last meeting of the US Federal Reserve.

[ad_2]