[ad_1]

The market has recently been consolidating, and now it looks as if we have finally run out of momentum.

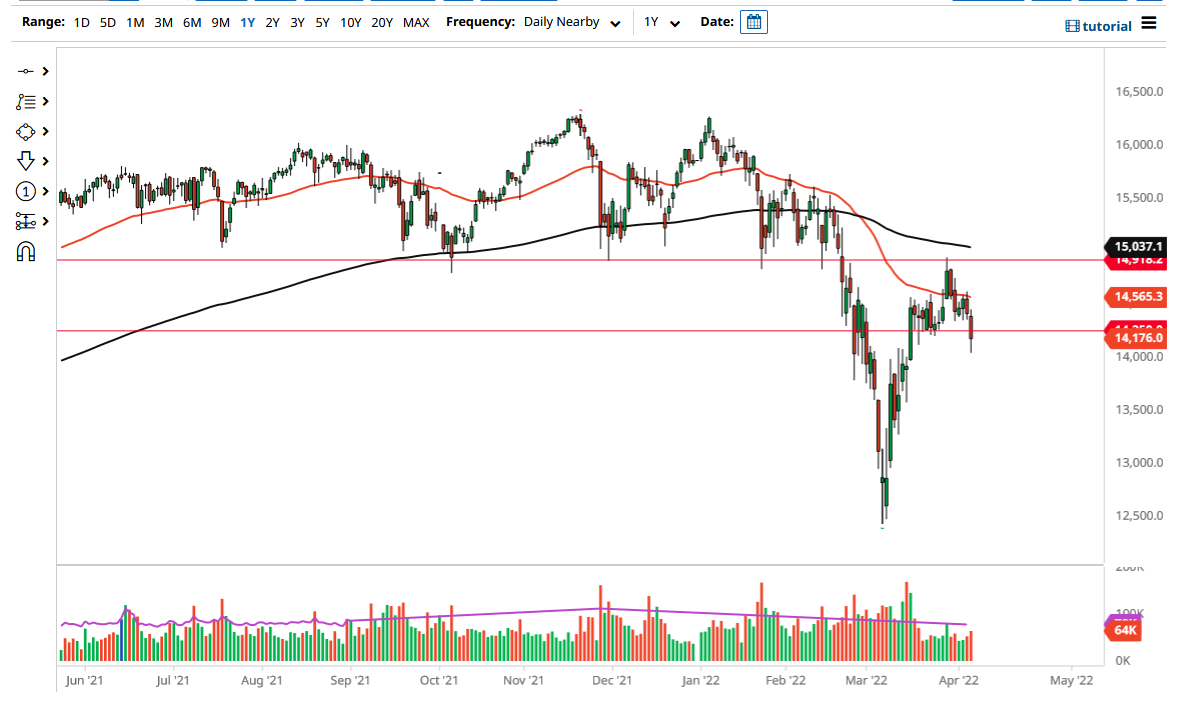

The DAX fell on Wednesday to break through a support level at the €14,250 level. This is a very negative turn of events, and it does suggest that perhaps the DAX is ready to fall further. In fact, if we break down below the lows of the session on Wednesday, I suspect that there will be a fresh wave of selling, especially if the €14,000 level gets broken through.

Current volatility is making great stock trading opportunities – don’t miss out!

Looking at this chart, you can see that the 50-day EMA has offered resistance over the last 48 hours, and now it looks like we are going to follow right along. Breaking through the €14,000 level opens up the possibility of a move to the €13,500 level, and then even €13,000. This is a market that had recently bounced quite viciously, but the fact is that some of the most vicious rallies occur during bear markets, and that might be what we have seen just happened.

If we rally from here, then I believe that the 50-day EMA, currently sitting at the €14,565 level, will drop significantly. At this point, I believe that should be dynamic resistance, and it should be perceived as such. The 50-day EMA being broken allows for the market to go looking to reach the €14,900 level. That being said, the market is going to come into contact with the 200-day EMA at that point, so even then I think it is probably somewhat limited to the upside.

For what it is worth, it looks as if stock markets around the world have fallen quite significantly, and I do think that it is probably only a matter of time before other indices propel the DAX lower. The market has recently been consolidating, and now it looks as if we have finally run out of momentum. In the short term, it is very likely that we will continue to see noisy behavior, so I would be cautious about my position size, considering that the market can swing quite viciously, especially as there are so many geopolitical issues, as well as the concerns about energy in the European Union. The German GDP numbers have recently been revised lower as far as estimates are concerned, and that has expectations of German performance going lower.

[ad_2]