[ad_1]

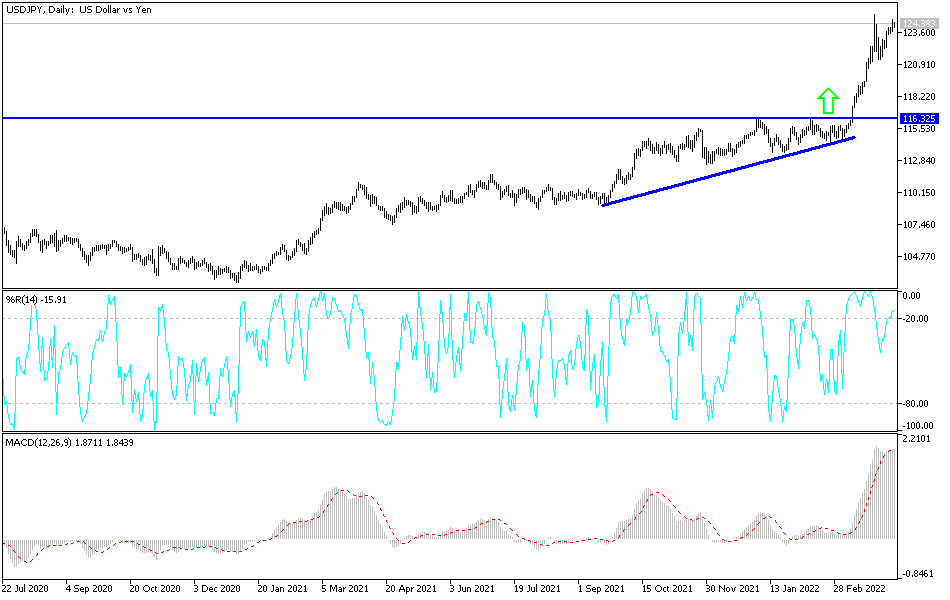

The general trend of the USD/JPY currency pair is still bullish,

In the same vicinity of the closing of last week’s trading, the price of the USD/JPY currency pair settled at the beginning of this week’s trading, stable around the 124.50 resistance level, the highest for the currency pair in six years. The US dollar is still enjoying strong momentum from expectations of raising US interest rates and improving performance, on the other hand, the Japanese yen, is being disappointed by the continued support for the Japanese economy to recover from the effects of the epidemic, as well as the repercussions of the Russian-Ukrainian war recently.

The gains of the US dollar against the rest of the other major currencies are important this week with the announcement of US inflation figures and retail sales figures. March may prove to be the highest for US inflation, but price pressures are likely to remain both high and persistent on the back of firmer demand for services and geopolitical risks.

With the annual inflation rate well above the Fed’s 2% target, officials have focused heavily on policy. They are expected to raise US interest rates by half a point in May and begin reducing assets on the central bank’s balance sheet. The Fed last month began what is expected to be a series of interest rate increases to tame inflation, but efforts to cool demand will take time to materialize. While some price pressures that have been particularly hot during the pandemic, such as those for used cars, are beginning to decline, others such as rents threaten to continue to rise.

US consumer prices likely rose 8.4% last month from a year ago, according to a Bloomberg survey of economists ahead of data due Tuesday. This would be the fastest annual rate of US inflation since early 1982, and reflects rising energy costs in the wake of the Russian invasion of Ukraine. The projected monthly gain of 1.2% would be the largest increase since 2005.

Economists expect the inflation rate for the world’s largest economy to stabilize at an average of 5.7% in the fourth quarter. However, this is about three times the annual rate seen in the years leading up to the pandemic. Such forecasts include assumptions that stress in supply chains will begin to subside and that the worst of commodity inflation is coming to an end as Americans shift more of their spending to services. Much of the faster inflation last year was driven by higher prices for goods such as cars and home furnishings, but these expensive items are often one-off purchases.

The Covid lockdown in China is a complicating factor, stressing already fragile supply chains and disrupting ports around the world. In this regard, Fed Governor Lyle Brainard said in a recent speech that she is watching whether service inflation accelerates as consumer demand for goods shifts. Within the CPI, the component that economists care about most is shelter rent, which makes up nearly a third of the overall index. In February, such costs recorded the largest monthly increase since 2005. This may affect how serious the Fed is to tighten monetary policy.

According to the technical analysis of the pair: So far, the general trend of the USD/JPY currency pair is still bullish, and investors do not care about the arrival of technical indicators towards overbought levels after the recent strong gains, where the discrepancy in economic performance and the future of monetary policy is still in favor of the US dollar. With the momentum halting, the currency pair may be subjected to a strong profit taking sale, and in general, there will be no change in direction without the currency pair moving below 120.00 – the previous psychological top.

The continuation of the factors for the dollar-yen pair’s gains does not rule out moving with it above the resistance 125.20 and 126.00 again.

[ad_2]