[ad_1]

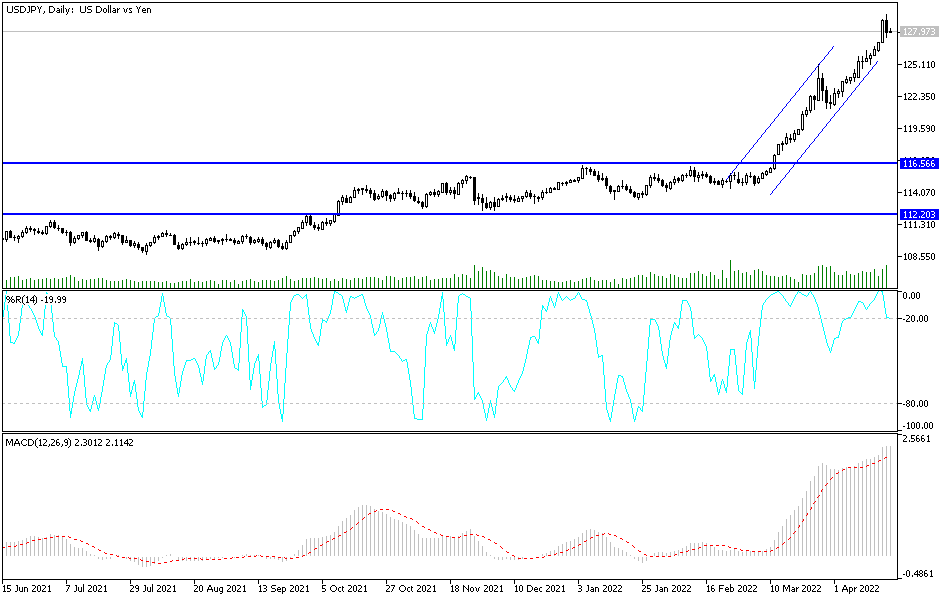

The bullish trajectory of the price of the US dollar against the Japanese yen continued, stable with gains around its highest in 20 years. The pair reached the resistance level 129.40, the closest to testing the psychological top 130.00, from which profit-taking operations were started. This indicated a lot about the possibility of it happening at any time. As a result, it retreated towards the support level 127.45 and settled around the resistance level 128.00 at the time of writing the analysis, waiting for an important trading day.

Yesterday the Japanese yen outperformed the other major currencies, but the risk of official intervention to curb any new or future losses remained high and in any such scenario, there is likely to be a further drop in the CHF/JPY rate compared to the USD/JPY. The Japanese yen remained the underperformer among the 2022 G-20 currencies on Wednesday after falling more than the Russian ruble and the Turkish lira, although it was by far the best performer on a two-day basis.

The price action came alongside widespread declines in the dollar’s exchange rates, strong gains for global stock markets, and higher commodity prices including crude oil prices, while coming on the heels of further expressions of concern by the Ministry of Finance over recent yen losses. Commenting on the performance, Derek Halpini, head of research and global markets at MUFG, warns, “If market participants become more confident that the Fed will need to raise interest rates to 3.00% and beyond to regain control of inflation, it will increase the likelihood of a retest. USD/JPY for the highs from 2002 when it reached a high of 135.15 and then from 1998 when it reached a high of 147.66.”

While the Japanese yen was the best performer on Wednesday, all factors believed to be driving its double-digit percentage losses against other currencies remained in place and could put more pressure on Japanese exchange rates in the coming days and weeks. Adam Cole, senior FX analyst at RBC Capital Markets says, “Both the pace of the depreciation of the Japanese yen and the spot USD/JPY level are very close to what it was at the time, so it would not be unprecedented for the BoJ/Ministry of Finance to move from verbal interference to physical interference.

“The Ministry of Finance/BoJ has not fully used verbal intervention tools yet – the next phase will usually involve describing moves as ‘speculative’ and threatening ‘decisive action’,” the analyst added.

The selling of the yen and the underlying factors prompted the Bank of Japan to announce on Wednesday a series of market operations to force the upper limit of 0.25% on the 10-year government bond yield. The effective upper bound on the bond yield referred to above is an important mechanism for transmitting the Bank of Japan’s overall monetary policy to the economy, but it is also a source of JPY losses. Deputy Prime Minister Yoshihiko Isozaki was – according to MUFG – the latest in a long line of officials to express concern about the Japanese yen’s price and this growing list has made analysts increasingly aware that there is a growing risk of official intervention to support the currency.

According to the technical analysis of the pair: The recent sell-off did not get the USD/JPY out of the general upward trend that still exists. Expectations of a move towards the psychological top 130.00 are still valid, as none of the currency pair’s gains factors have changed, the most prominent of which is strong expectations for the future of tightening the US Federal Reserve’s policy, while the Japanese central bank keeps negative interest rates.

According to the performance on the daily chart, the first reversal will be important if the dollar-yen pair moves towards the support level 125.30. The dollar-yen pair is on a date today with the announcement of the number of weekly jobless claims and the reading of the Philadelphia Industrial Index, then statements by Federal Reserve Governor Jerome Powell.

[ad_2]