[ad_1]

Expectations of raising US interest rates strongly during 2022 still support strong gains for the US dollar against the rest of the other major currencies. As a result, the price of the USD/JPY currency pair moved towards the resistance level of 129.40, the highest for the currency pair in 20 years. For four trading sessions in a row, the USD/JPY pair was exposed to profit-taking operations, reaching the level of 127.40 at the time of writing the analysis. Despite the recent performance, the general trend of the currency pair is still bullish and may continue to maintain its gains until the US Federal Reserve announces its monetary policy decisions in the coming days.

The yen is a popular asset during turbulent times.

Expectations still indicate that the US central bank is ready to raise US interest rates by half a point or more at this meeting.

Highlighting the week leading up to my respective Thursday and Friday releases of US Q1 GDP data and the core PCE price index for March, the Fed’s preferred gauge of US inflation and potential downside risks to the dollar this week. This is because the consensus of economists envisions a second consecutive drop in inflation on a monthly basis, which would fuel speculation about a possible peak in price pressures in the US and could also be strongly influenced by dollar sails over the coming days.

Commenting on this, Jane Foley, FX Analyst at Rabobank said, “The US dollar continues to display well on hawkish comments from the Fed. However, since the publication of 8.5% year-on-year US CPI inflation on April 12, the debate over whether the US has reached “peak inflation” demands attention.

Recently, Federal Reserve Chairman Jerome Powell blessed a half-point rate hike next month and signaled support for more aggressive tightening to curb inflation by noting that he saw advantage in “front-loading” policy moves. “I would say 50 basis points will be on the table for the May meeting,” Powell told a panel hosted by the International Monetary Fund last Thursday in Washington that he shared with European Central Bank President Christine Lagarde and other officials. “We are really committed to using our tools to bring back the 2 percent inflation rate,” he said, referring to the Fed’s target for annual rate increases.

Interest rate futures are pricing in a half-point move in the benchmark lending rate when US central bankers meet on May 3-4 and another half-point hike is priced for the entire month of June. Investors are betting on a third half-point increase for July, and Powell’s colleague at the St. Louis Fed, James Bullard, has opened a discussion about a more aggressive 75 basis point increase if needed.

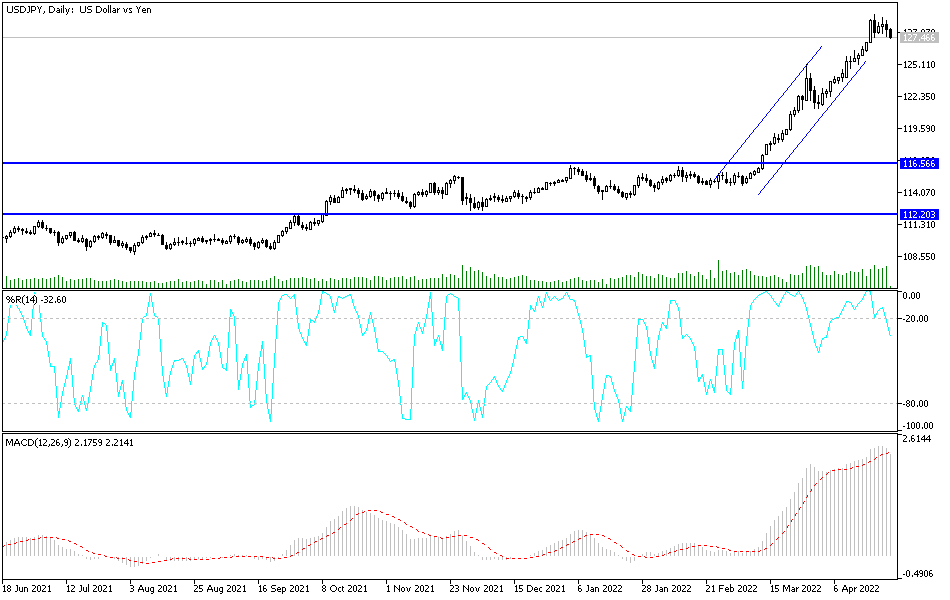

Despite the recent sell-offs, the general trend of the USD/JPY currency pair is still bullish. The descending channel will not be broken, according to the performance on the daily chart below it, without the currency pair moving towards the support levels 125.00 and 122.20, respectively. On the other hand, and over the same time period, the resistance 128.20 will remain important for expectations of the psychological top 130.00, and the discrepancy in the economic performance and the future of raising interest rates from global central banks will remain factors that support the upward trend of the currency pair.

Today, the USD/JPY pair will be affected by the risk appetite of investors, as well as the reaction to the announcement of the results of the US economic data, the durable goods orders, the US consumer confidence and the US new home sales.

[ad_2]