[ad_1]

Ultimately, the market will continue to fluctuate with risk appetite, which is horrible at this point.

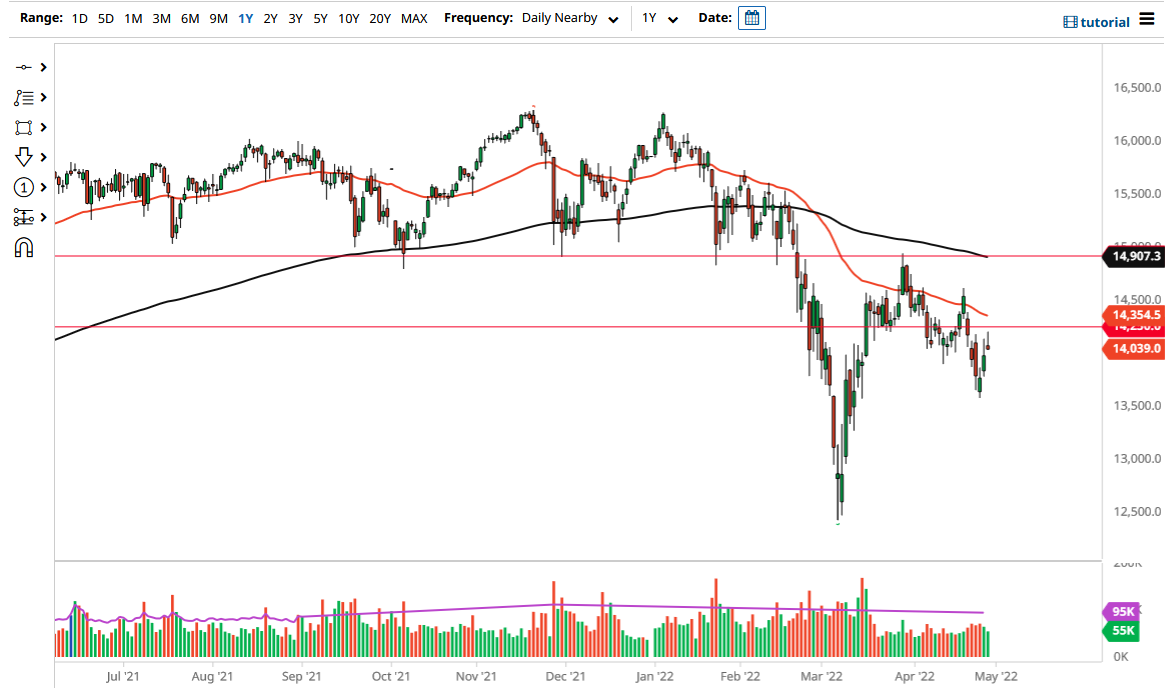

The German DAX Index gapped higher in the futures market on Friday to show signs of promise. However, we have seen a lot of resistance near the €14,250 level again and then sold off to form a shooting star. This suggests that we are going to continue the overall downtrend, and it is likely that the DAX will find plenty of selling pressure. The gap that we kicked off the day with still has not been filled, at the vsoery least, you would expect that to happen.

If we break down below the gap, then the market is likely to go looking to the €13,750 level, maybe even the €13,600 level underneath that. That is where we had bounced from previously but clearing that allows much more selling going forward. Furthermore, we are in a down-trending channel, and it suggests at this point that we may accelerate that move.

Keep in mind that Germany is very likely heading into a recession, so it makes sense that the DAX will continue to see plenty of pressure to the downside. On the other hand, if we were to turn around and break above the 50-day EMA, which is currently at the €14,350 level and shrinking, we could see a complete turnaround, but at this point I just do not see the momentum in this market. This is especially true after the lack of follow-through on the move higher. Ultimately, the market will continue to fluctuate with risk appetite, which is horrible at this point.

When I look around the world, it is obvious that there are a lot of indices that all look very weak, so I think the DAX will not be any different. The overall attitude of equities around the world continues to be very soft, and with the energy concerns, inflation, and lack of growth in the European Union, Germany will be the first place people start to short as it is Europe’s largest economy. Furthermore, we have the war going on in Ukraine, which of course has a lot of people concerned about what could happen with the European economy on the whole. The ECB is essentially stuck, and at this point cannot do much, so I think equities are at the mercy of short-sellers.

[ad_2]