[ad_1]

I think you should be cautious about trying to get long of the S&P 500, at least for anything more than a short-term bounce.

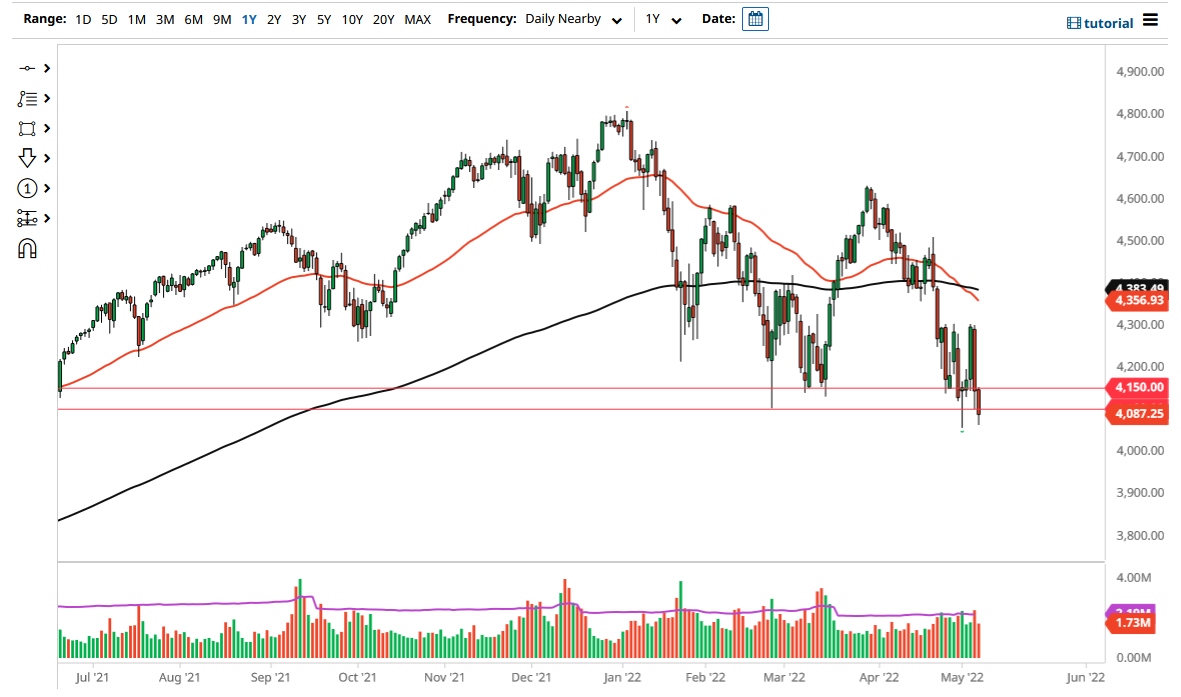

The S&P 500 fell Friday and the jobs number came out better than anticipated, suggesting that perhaps the Federal Reserve is willing to continue its tightening policy. While it is good for the US dollar, it is typically bad for the stock market. Ultimately, this is a market that I think is on the precipice of breaking down significantly, so we need to be very cautious about what we do next, but it is obvious that we are barely clinging to life.

The 4000 level underneath will be a significant round figure that a lot of people will pay attention to, but if we were to break down below there, the market then opens up too much further selling pressure. Quite frankly, with the 50-day EMA crossing below the 200-day EMA, it is likely that we will continue to see downward pressure for longer-term traders. Interest rates rising and a significant concern with inflation continues to be a major issue for the stock market, as it looks like the US economy is almost certainly heading for a slowdown.

There is still a lot of debate as to whether or not we are heading into a recession, but I would be stunned if we did not. With this being the case, I like the idea of fading rallies, as the markets will continue a lot of negative headlines out there to push things lower. If we break down below the hammer from the beginning of the week, that would be your first sign that we are going to attempt a breakthrough below the 4000 handle.

On the upside, if we were to turn around a break above the 4300 level, it would be very bullish. I suspect at best we are looking to break above the highs of the Friday session, which could have the market re-entering the previous consolidation range. That is probably your best case scenario, and therefore I think you should be cautious about trying to get long of the S&P 500, at least for anything more than a short-term bounce. Ultimately, I do not like this market and I think every time it rallies you have to be looking at the potential for the market to start selling off again.

[ad_2]