[ad_1]

The only thing that I can say here is that we are going to see a lot of volatility in this market, just as we see everywhere else.

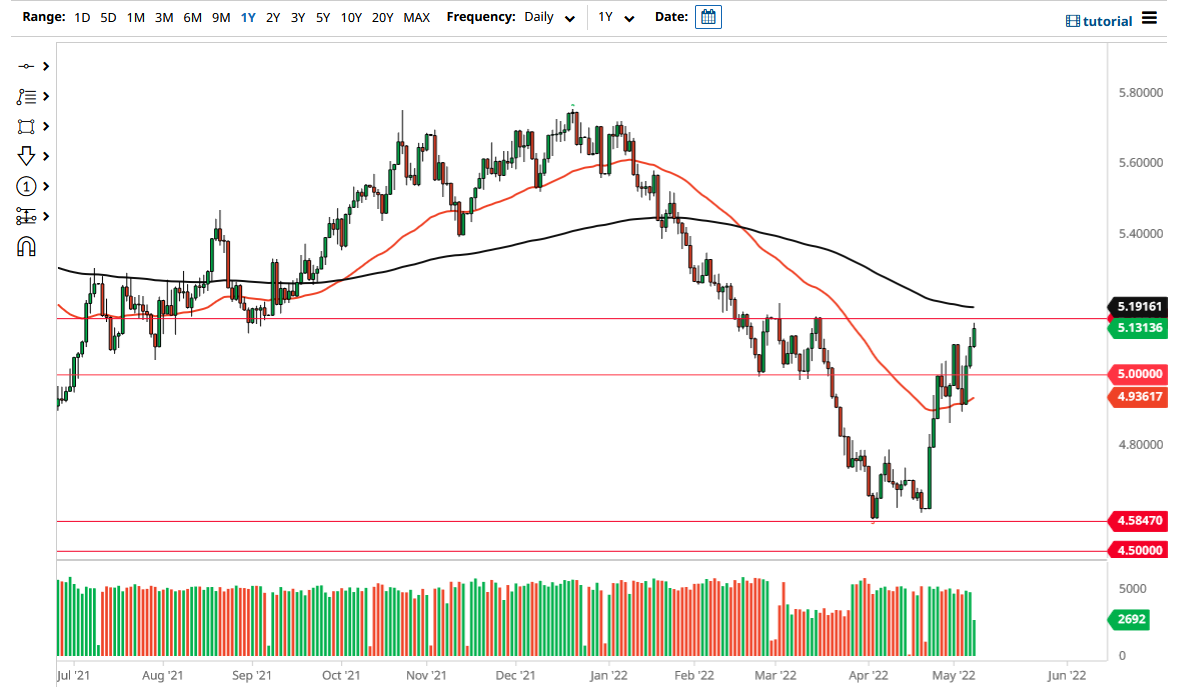

The US dollar rallied a bit on Monday, as it looks like we are getting ready to threaten the 5.15 real level. This is a level where I have seen quite a bit of resistance previously, so it will be interesting to see how this plays out. It is also worth noting that the other emerging market currencies look very similar, as they all are facing a major resistance barrier before the greenback can continue to go higher.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

What else is important is that the 200-day EMA is sitting just below the 5.20 level, which is an area where I would consider buying on the breakout. The market will continue to see a lot of noisy behavior in this area, but if the US dollar does in fact continue to take off against everything, the Brazilian real probably will not be any different. That being said, the market is a little bit different over here, as the Brazilian real has been the best-performing currency against the greenback this year, but it is probably only a matter of time before the strength of the US dollar continues to work against everything else.

Brazil has a little bit of a cushion due to the fact that it is highly sensitive to soft commodities, all of which have done fairly well this year. That being said, it will be interesting to see how this plays out going forward because inflation will eventually work against these currencies. That does not mean that we cannot continue to see this pair drop, but I would not be a seller until we break down below the 5.00 level. If that happens, then we could see a move down to the 4.80 level.

The only thing that I can say here is that we are going to see a lot of volatility in this market, just as we see everywhere else. Whether or not that kicks off a bigger move remains to be seen, but I would think that it will eventually get to that point. I think the next couple of days should give us quite a bit of clarity as to which direction we could go next. A little bit of patience will probably go a long way.

[ad_2]