[ad_1]

Gold prices continued to decline, losses of the yellow metal this week, and reached the support level of $ 1832 for an ounce, the lowest in three months. The downward pressure came in conjunction with the rise in the price of the US dollar near its highest levels in two decades, amid expectations that the Federal Reserve will raise US interest rates in the coming months. Accordingly, the dollar index rose to 103.98, although it remained somewhat sluggish earlier in the day.

On the other hand, lower long-term bond yields helped limit the decline in the price of gold.

In the same performance, silver futures closed at $21.424 an ounce, while copper futures settled at $4.1545 a pound.

Today, Wednesday, investors and markets are awaiting the release of US inflation data, which may affect the monetary policy of the Federal Reserve. The Labor Department is due to release its report on consumer price inflation today, with the annual rate of price growth expected to slow to 8.1% in April from 8.5% in March. The recent snapshot of inflation could affect expectations about how aggressively the Federal Reserve plans to raise US interest rates.

Wall Street indices ended a choppy day of trading with a mixed close on Tuesday, after a rally in technology stocks helped reverse an early slide. Accordingly, the S&P 500 index closed 0.2% higher, cutting a three-day losing streak, after swinging between a gain of 1.9% and a loss of 0.8%. The day before, the benchmark index fell 3.2%, hitting its lowest level in more than a year.

The Dow Jones Industrial Average was down 0.3%, while the Nasdaq Technology Index was up 1%. Big tech stocks, which have been swinging sharply up and down lately, helped cope with losses elsewhere in the market. The subtle market action came ahead of the Labor Department’s release of the US Consumer Price Index, a key economic report on inflation that investors will be watching closely as they try to gauge how aggressively the Federal Reserve is in raising interest rates while fighting inflation.

In contrast, US Treasury yields have risen, and stocks have been very volatile lately as Wall Street adjusts to a strong shift in the Fed’s policies away from supporting the economy. Where the central bank raises interest rates from their historical lows to combat the ever-increasing inflation, which reached its highest level in four decades. The Fed has raised its benchmark interest rate from nearly zero, as it has sat for most of the coronavirus pandemic. He indicated last week that he would double the size of future increases.

Higher prices for raw materials, freight and labor have slashed companies’ financial results and prospects. Many companies are raising prices on everything from clothing to food, raising concerns that consumers will eventually cut back on spending, hurting economic growth.

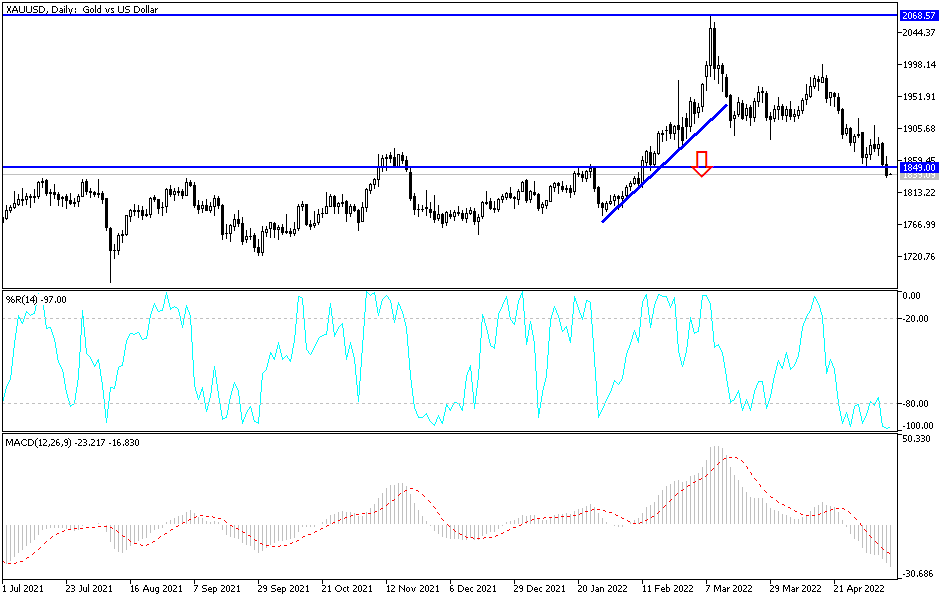

According to the technical analysis of gold: On the daily chart, the recent losses of the gold price have moved the technical indicators towards oversold levels and buying may be considered in preparation for the expected rebound in the gold price to rise again. The support levels of 1815 and 1790 may be the most appropriate to think about that. Global financial reaction from the announcement of US inflation figures.

In addition, global geopolitical tensions led by the Russian-Ukrainian war, along with fears of an epidemic, still represent a good environment to prevent the complete collapse of the gold price in light of the general trend of global central banks towards tightening their monetary policy. On the other hand, the psychological resistance of 1900 dollars for an ounce is still the most important for the bulls’ return to control the trend.

[ad_2]