[ad_1]

The EUR has a medium-term bullish potential, which indicates that a long streak of losses will fade soon.

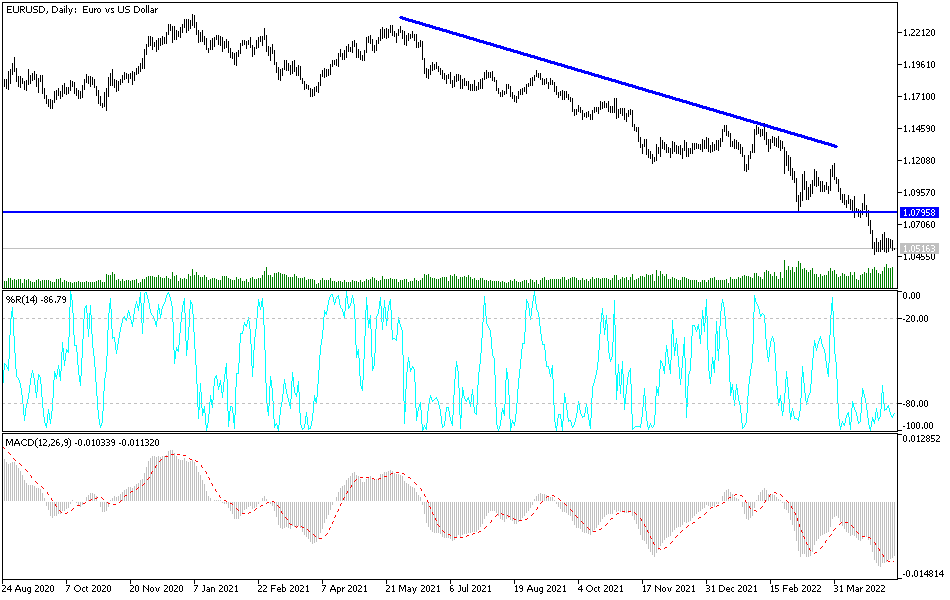

Despite the recent stability of the EUR/USD currency pair’s performance, the US dollar continued its strength. The bears found an opportunity to launch lower again, and the currency pair retreated towards the support level 10501 and settled around it at the beginning of trading today, Thursday. The US currency is still the strongest with expectations of a strong interest rate hike during 2022 by the US Federal Reserve.

The peak of the dollar’s strength has passed, and the euro will show bullish traits in the medium term. New research from French banking giant BNP Paribas shows in a regular monthly briefing on the currency’s future, analysts with the bank say the dollar “may be near its peak” and is now trading “too rich” relative to its long-term fair value as reported by the BNP Paribas FEER model.

“We expect this assessment gap to narrow as central banks outside the US start their tightening cycles while the Fed tightening cycle matures,” says Alexander Zhikov, forex analyst at BNP Paribas in London. Further analysis from BNP Paribas has found that the dollar tends to peak around the start of the Fed’s walking cycle. The results come in the same week as the dollar soared to new multi-year highs, spurred by the promise of a 50 basis point interest rate hike at the Federal Reserve and a downturn in global stock markets.

Meanwhile, fears of slowing global growth provide the traditionally supportive backdrop as the counter-cyclical dollar tends to rise. Accordingly, the EUR/USD exchange rate fell as low as 1.0475 and now appears to be stabilizing at levels between 1.05 and 1.06. But these could be lower levels if BNP Paribas is right.

“We expect a significant decline in the US dollar with EUR/USD and AUD/USD rising to 1.14 and 0.80 respectively by the end of the year and USD/JPY dropping to 120,” the bank’s analysts add.

The EUR has a medium-term bullish potential, which indicates that a long streak of losses will fade soon.

Meanwhile, BNP Paribas’ custom STEER model found the largest understatement in the EUR/USD spot rate since the model’s inception. Economists are also now in tune with the possibility of an upcoming rate hike from the European Central Bank, with signs that the move in July is becoming increasingly clear.

The European Central Bank has long favored ultra-low interest rates, but rising inflation has forced a rethink and increasingly Governing Council members are of the view that interest rates should return to above 0%. This normalization would provide some support to the interest rate for the euro, which it has been lacking for a long time. BNP Paribas, for its part, now expects the ECB to raise rates earlier than previously envisaged and see the first increase in September, although the move in July was a close call.

They now expect a cumulative tightening of 175bps through the end of 2023 (50bps more than they previously thought).

With the ECB on course for policy normalization, ultra-cheap valuations and extended short positions in EURUSD (tactically and structurally in our view), we continue to look at the medium-term trend in terms of the upside. We expect the EUR/USD to rise to 1.14 by the end of 2022 and 1.20 by the end of 2023.

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair, as the general trend is still bearish. Breaking the 1.0500 support will increase the chance of further collapse, despite the technical indicators, after the recent losses, reaching oversold levels. Currently, the nearest trend targets are 1.0455 and 1.0300, respectively. On the other hand, according to the performance on the daily chart, the bulls must launch towards the resistance levels 1.0790 and 1.1000 to confirm the change in the current bearish outlook. The euro is not awaiting any important economic data, and the US dollar will be on a date with the announcement of the US producer price index, one of the tools for measuring US inflation. This is also in addition to announcing the number of weekly unemployed claims.

[ad_2]