[ad_1]

The euro took a hit amid another hike in natural gas prices, this time on news of new moves by Russia to restrict supplies to Europe. Accordingly, the price of the EUR/USD currency pair fell to the lowest support level of 1.0349 for the most popular currency pair in the forex market, and closed last week’s trading, stable around the 1.0407 level, in light of the continuation of the downward trend.

After the recent sharp losses, expectations have increased that the EUR/USD is on course to test parity according to current trends, some analysts say, but losses were also notable against the British pound and most other G10 currencies. Thus, the incurring of euro losses everywhere confirms that the currency is affected by special factors. Natural gas prices in Europe have recently risen after news of Russia’s imposition of sanctions on energy companies, specifically a major Polish pipeline, which may lead to increased pressure on supplies to Europe.

Russia imposed sanctions on EuRoPol GAZ SA, the owner of the Polish part of the Yamal-Europe gas pipeline.

Russia has also imposed sanctions on units of Gazprom Germania and dozens of other companies located in countries that have imposed sanctions against Russia in response to its invasion of Ukraine. 31 companies were listed on May 11 by the Russian government and are now banned from conducting transactions and entering Russian ports.

Gas prices are up, and markets are trading deep in the red, with Germany’s DAX down more than 2.0%. Commenting on this, Kit Juckes, FX Analyst at Société Générale says, “The bottom line is that we cannot accurately price the risk of disruption to gas supplies in Europe, but if it did, the risk of a break in the EUR/USD parity would be significant, and this maintains motivation Naturally, to start selling in the long term in euros.”

It was also reported that the flow of Russian gas in a major pipeline to Europe via Ukraine had been disrupted by the withdrawal of Russian occupying forces, according to the operator of the Ukrainian gas network. For its part, the Ukrainian Gas Transmission System Operating Company (JETSO) said that gas flows stopped from seven in the morning last Wednesday at the Sukhranivka point, through which a third of the Russian gas that passes through Ukraine passes.

The operator said that the reason was that it had lost control of the equipment in the occupied territories. “With the eurozone economy highly dependent on Russian gas and oil, we expect the euro to be the hardest hit currency in the G10 due to the war in Ukraine,” says economist Claudio Wewill of J. Safra Sarasin, a Swiss private bank and wealth manager. And although gas prices in the UK are also rising, reports indicate that Britain has an “unprecedented glut of LNG”, that gas shipped from the US and the Middle East. It is discharged at British ports in liquid form, gasified, and then sent to Europe via interconnected pipelines.

This means that Britain’s gas supplies for next day delivery fell to their pre-energy lows sometime this week before the news of Russian sanctions. The Times reported that demand for gas in Britain has fallen as the temperature has risen and there is not enough pipeline capacity to carry all the gas that has reached mainland Europe where it is needed.

According to the report, LNG shipments are arriving at terminals in Britain with the aim of transporting it across the national grid and to Europe via subsea pipelines.

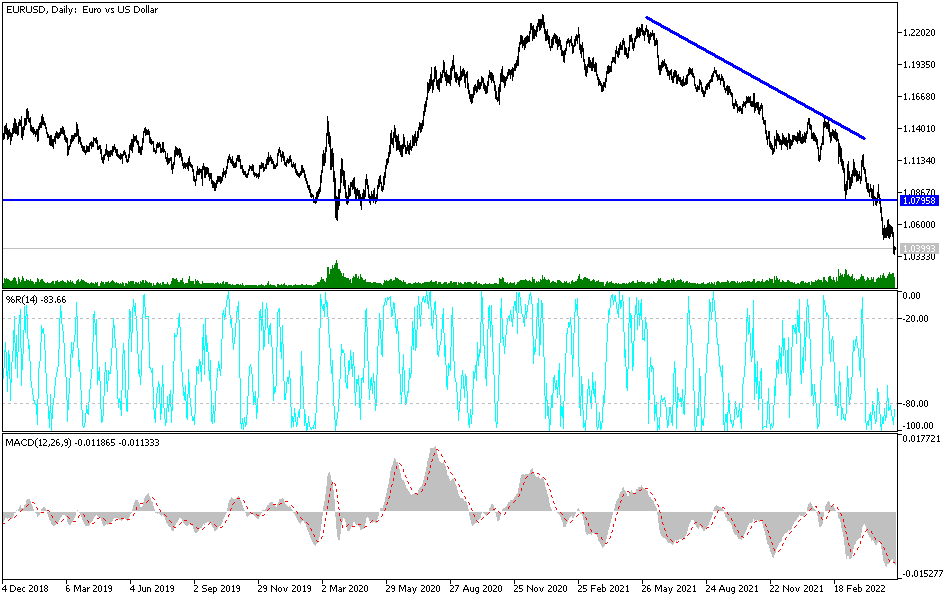

According to the technical analysis of the pair: The general trend of the EUR/USD currency pair is still bearish. Investors do not care about the arrival of technical indicators towards oversold levels. The continuation of the pressure factors on the currency pair that I mentioned a lot, is represented in the disparity in economic performance and the future of monetary policy tightening between The Federal Reserve Bank and the European Central Bank.

The closest bears targets for the EURUSD price is to move towards the support levels 1.0325 and 1.0200 and then the parity price. On the other hand, according to the performance on the daily chart, breaking the resistance 1.0800 will be important in changing the trend

[ad_2]