[ad_1]

There are a slew of earnings this week that could also come into the picture and cause a few headaches along the way.

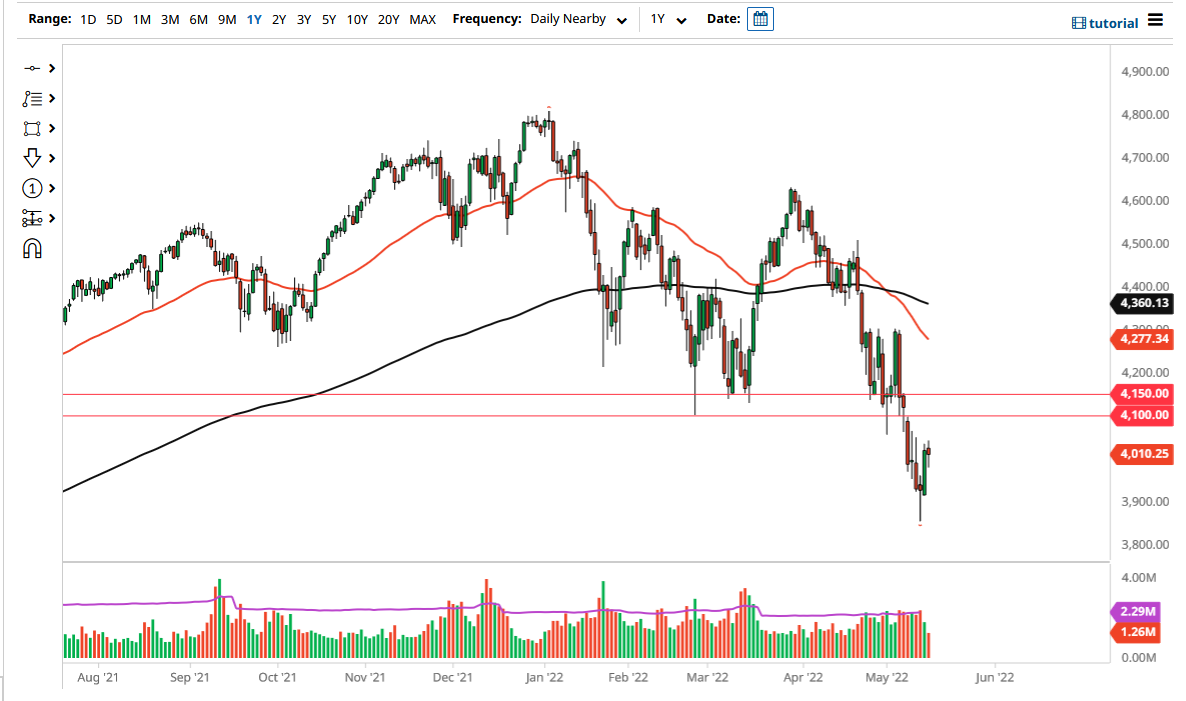

The S&P 500 did very little on Monday as we have run out of momentum. That being said, the market looks as if it is trying to figure out what to do next, after that massive recovery on Friday. Because of this, I think the market will ultimately have to figure out what it wants to do based upon risk appetite, but it is worth noting that after that massive move higher on Friday, the markets did not do much. Because of this, I anticipate that we are going to continue to see a bit of negativity, due to the fact that we could not get any follow-through on the rally. Furthermore, not much has changed and I think that a lot of what we had seen on Friday was more or less going to be profit-taking.

If we break down below the bottom of the candlestick for the trading session on Monday, then it is likely that we will continue to see this market be noisy, as the economic outlook for the entire world, let alone the United States, is shady at best. There are lots of concerns about inflation, supply chain issues, and geopolitics. At this point, I think you will continue to fade rallies as they show signs of exhaustion and give you an opportunity to do so. The market breaking down below the bottom of the candlestick for the day would show a continuation of the overall trend, but you could also point out that we have tried to rally multiple times in a row, and that does suggest that at least there are some buyers out there trying to turn things around. I would not hold my breath at this point, but clearly there is a significant amount of effort at least being thrown at the market. It is also worth noting that we are hanging about the 4000 level, which is psychologically important, but whether or not it holds as structurally important is a different question. Above current trading we have the 4100 level offering structural resistance that extends to the 4150 level. That being said, it is not until we break above all of that that you can even begin to suggest that you should be a buyer of this market. There are a slew of earnings this week that could also come into the picture and cause a few headaches along the way.

[ad_2]