[ad_1]

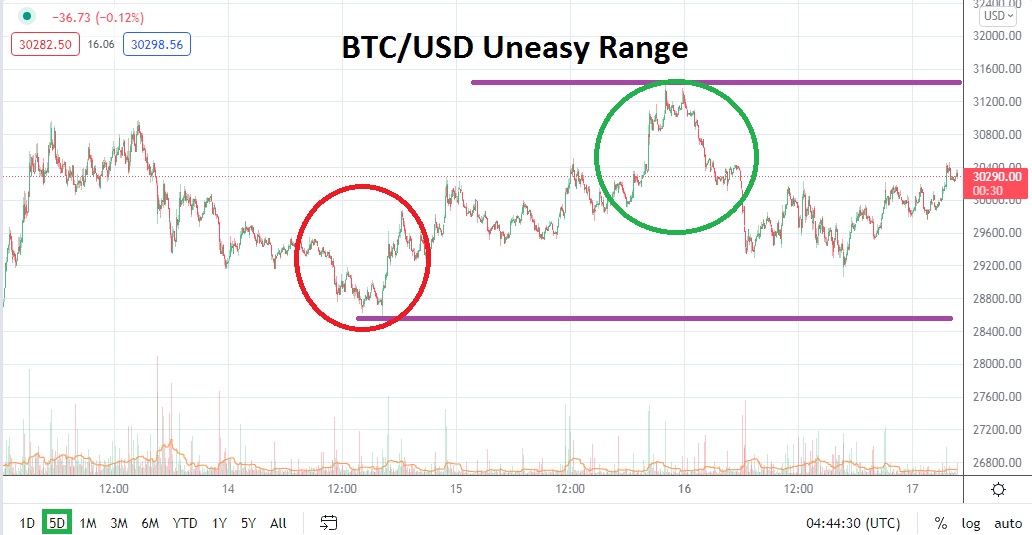

BTC/USD is within an uneasy price range as it continues to linger unsteadily, leaving speculators with questions regarding their perceptions.

BTC/USD is near the 30,400.00 ratio as of this morning. Trading for the moment almost appears to be tranquil for Bitcoin, but as speculators know, the potential for sudden volatility and price moves of one thousand USD within fast durations is always possible. The thought that BTC/USD is going to continue to produce polite movements in the near term will probably be disproved abruptly.

BTC/USD has seen a dramatic loss of value the past week, but the ability of BTC/USD to climb above the 30,000.00 and sustain this level this morning should get the attention of traders. However, the question regarding this development in the short term, is where technical perceptions lead the decision making process of traders. Having suffered from what has become a notorious bearish trend and having demonstrated the ability to literally crash to long term lows in the blink of an eye, anyone considering trading Bitcoin as a speculative wager has to be prepared for the chance of chaos.

The broad cryptocurrency market continues to produce extreme volatility and it has mirrored in many ways, the results from equity indices such as the NASDAQ 100. However the results in BTC/USD and its major counterparts in the digital asset world are producing more destructive percent changes of value, meaning that short term traders of cryptocurrencies including Bitcoin need to use secure risk taking tactics.

It is likely in the near term that BTC/USD will remain volatile and that nervous results will continue to be demonstrated with sudden fluctuations. The current price of BTC/USD has shown some stability and incrementally has increased the past half day, and in recent hours. Technically traders need to decide if the move higher in BTC/USD can be sustained and until higher price levels are attained, many speculators may not want to pursue potential upside momentum. Yesterday’s high in BTC/USD did trade above 31,000.00 rather comfortably, but it quickly saw a reversal.

Traders of BTC/USD are urged to use entry level price orders. The use of take profit and stop loss orders should be a tactical decision too, this in order to take advantage of the price range Bitcoin is now trading. Speculators who are still skeptical of BTC/USD and its ability to sustain a higher climb might want to be sellers around technical resistance and look for quick hitting reversals lower. If BTC/USD is not able to break through the 31,000.00 ratio near term and sustain this value, this may be a negative signal for Bitcoin.

Bitcoin Short-Term Outlook

Current Resistance: 30506.00

Current Support: 30202.00

High Target: 31495.00

Low Target: 28639.00

[ad_2]