[ad_1]

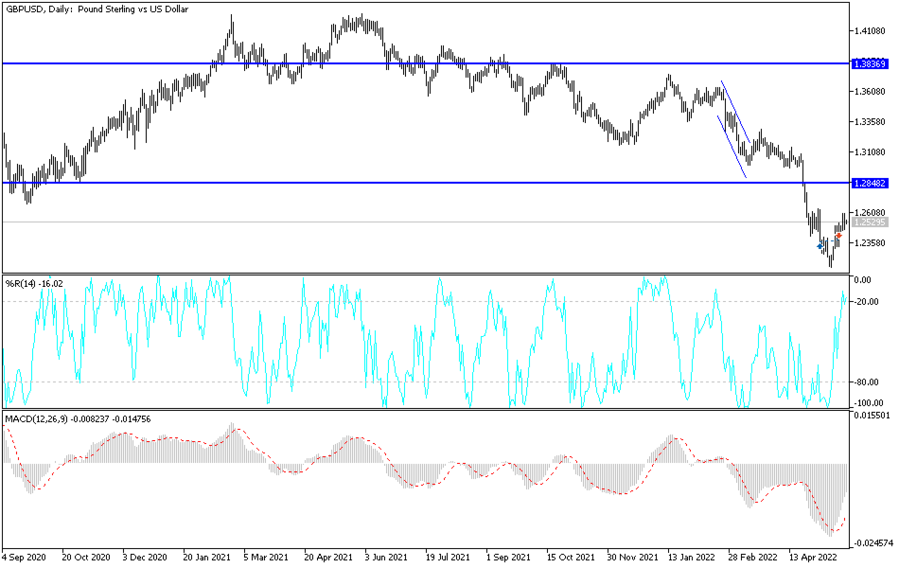

The price of the GBP/USD currency pair resumed its rapid decline from the 1.2600 resistance level to the 1.2471 support level, after the release of the PMI data. This indicated that the British economy was on the verge of contraction in May and that conditions are deteriorating faster than they were situation during the epidemic. The GBP/USD pair is stable around the 1.2530 level at the time of writing the analysis.

The release of the S&P Global PMI for May showed that the UK services sector barely grew with a PMI reading of 51.8, down from 58.9 previously and well below the 57 forecast by analysts. Such a sharp month-to-month drop is almost unprecedented: the monthly loss of momentum in May was the fourth largest on record and surpassed anything seen before the pandemic.

The manufacturing sector held slightly better, but with the manufacturing PMI reading at 54.6, down from 55.8 in April and less than the expected reading of 55. The composite PMI for May – which gives a broader glimpse into the economy – came in at 51.8, less than Expected 56.5 and 58.2 in the previous month.

The data and the pound’s reaction underscore why JPMorgan described the UK as the “poster child” of stagflation when it lowered its forecast for sterling earlier this month. The data also contrasts unfavorably with figures from Europe where the Eurozone PMI data showed continued strong growth in May.

For its part, the global agency Standard & Poor’s reported that private sector companies in the United Kingdom indicated a sharp slowdown in business growth during the month of May as mounting inflationary pressures and rising geopolitical uncertainty constrained customer demand. Indeed, the data pointed to the fastest rise in operating expenses. Since this indicator was launched in January 1998. Moreover, concerns about shrinking margins and weak order books have significantly lowered business expectations for the coming year.

S&P Global has also reported that weak trade dynamics in Britain have been dragging on activity as manufacturers reported the largest drop in export orders since June 2020. A number of commodity producers cited Brexit-related trade frictions as the main contributing factor. Export sales declined in May, particularly regarding new customs rules, additional documentation requirements and other complications with EU trade, according to Standard & Poor’s Global.

However, the data showed a strong rise in employment numbers as companies continue to catch up on unfinished work, S&P Global reports, although the job creation rate has eased slightly since April and has been the least noticeable for 13 months.

The results should continue to support expectations that wages will remain strong going forward. Inflationary pressures remain a concern as average cost burdens rose rapidly in May, with input price inflation at private sector firms hitting a new record high in the survey.

This was driven by the accelerating rise in cost pressures in the service economy, with this indicator reaching its highest level since the survey began in July 1996.

According to the technical analysis of the pair: The performance of the GBP/USD currency pair is in a neutral position with a bearish bias. The bears’ control will strengthen if the currency pair returns to the support levels 1.2465 and 1.2300, respectively. With the last level, expectations of psychological support will return to 1.2000 again. On the other hand, the bulls will collide in the event of a return to control with the resistance levels 1.2635 and 1.2775. Continuing pessimism on the part of the Bank of England and the results of British releases will continue to support the selling of sterling from every upward level.

[ad_2]