[ad_1]

Amid the recovery of the US dollar, gold prices fell to the level of 1835 dollars an ounce, starting from the resistance level of 1857 dollars an ounce during yesterday’s trading session. The price of gold is stable around the level of $ 1838 an ounce at the time of writing the analysis, waiting for any news. Gold futures fell below an important psychological support level as the yellow metal is on track for another monthly loss. In recent weeks, gold prices have taken a hit on the prospect of higher interest rates, despite inflation at a 40-year high.

Overall, gold prices are poised to drop 0.75% in May, the second consecutive monthly decline. From the start of 2022 to date, the price of gold is still up about 1%. In the same way, silver, the sister commodity to gold, will suffer a sharp monthly decline. As silver futures fell to $21.80 an ounce. The white metal will record a decline of 3.9% in May, adding to its decline since the start of the year 2022 to date by about 7%.

The gold market has faced several headwinds lately, from a strong US dollar to higher interest rates to slowing inflation. Although the US Dollar Index (DXY) will post a massive monthly loss of 1.6%, the index is still up more than 6% this year. The value of the consolidation is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

US Treasury yields rose on the first day after the Memorial Day holiday, with the benchmark 10-year yield rising 11.9 basis points to 2.688%. One-year bond yields jumped 7.1 basis points to 2.061%, while the 30-year bond yield rose 9.6 basis points to 3.072%. Gold is generally sensitive to a higher interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures fell to $4.2925 a pound. Copper futures rose to $954.30 an ounce. Futures contracts for palladium fell to 1988 dollars an ounce.

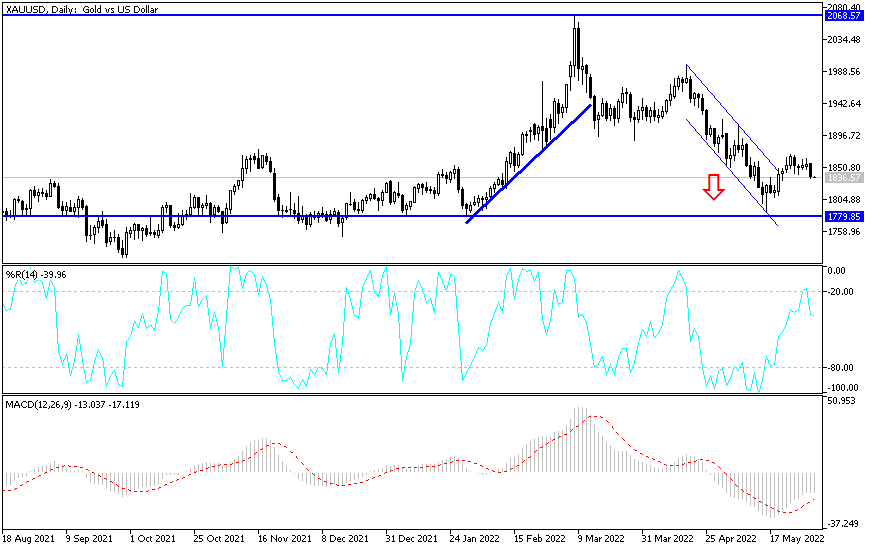

According to the technical analysis of gold: The recent performance of the gold price was normal, after attempts to rebound up and stop the gains. The price of gold did not find enough momentum to continue the rise, and I still prefer to buy gold from every descending level, and the support levels of 1829 and 1815 dollars are the most appropriate to do so. The gold market still has factors that might push it upwards in the future, which are the continuation of the Russian-Ukrainian war and its negative repercussions on the future of global economic recovery.

The resistance levels of 1865 and 1880 are important for the bulls to regain control of the trend. I expect movements in narrow ranges for the gold market until the US jobs numbers are announced.

[ad_2]