[ad_1]

EUR/USD failed in its attempt to climb from its lowest level in nearly five years. The European Central Bank (ECB) may need to beat the already hawkish market on Thursday to maintain recovery momentum ahead of the latest US inflation data. The euro-dollar fell to the level of 1.0670 at the time of writing the analysis and tried in the beginning of trading to stabilize around 1.0750. The strength of the US job numbers, which were announced at the end of last week, supported the expectations of the path of raising US interest rates strongly during the year 2022.

The euro received some impetus from a hawkish market repricing of the European Central Bank’s interest rate expectations ahead of the June monetary policy decision. Thursday’s policy decision and subsequent press conference are widely expected to herald the announcement of the end of the European Central Bank’s latest and longest remaining quantitative easing program, while providing insights into the likely future path of interest rates.

The forex market will be more interested in anything revealed about the ECB’s potential policy actions in July and September, and specifically, any indications of an increase with which eurozone interest rates could rise in July.

The euro is also likely to listen closely for clues about the pace and potential size of additional steps after that given that the recent shift in prices has left some markets indicating that investors and traders expect the ECB deposit rate to rise by 0.35% next month and by a total of 1.25% this year.

This would push the deposit rate above zero, putting an end to the long era of negative interest rates that saw commercial banks charged for depositing money in the safe haven represented by the European Central Bank, and potentially representing a turning point for the euro-dollar rate expectations.

This all follows a public discussion among board members over whether to raise the benchmark in a typical 0.25% or 0.50% larger increase in July, and after an expected end to the ECB’s last remaining quantitative easing program this week. Jeremy Stretch, FX analyst at CIBC Capital Markets says, “HICP inflation is now 3% higher than it was before the last forecast update. As a result, this may result in Lagarde not completely ruling out a response that is more aggressive than graduated movements by 25 bps.” “Any realization like this would help to continue to support the euro,” he added.

Overall Thursday’s decision comes after Eurostat figures revealed last week that the rate of inflation in Europe jumped to a new record high of 8.1% in May, significantly eroding the gap between annual levels of price growth in the eurozone and those in the United States where inflation was Annual another 8.3%. This may indicate that the inflection point is approaching not only the relative trans-Atlantic equilibrium of inflation pressures but also likely the relative position of interest rate policy in Europe and the US as well, which could have spillover effects on the EUR/USD rate outlook.

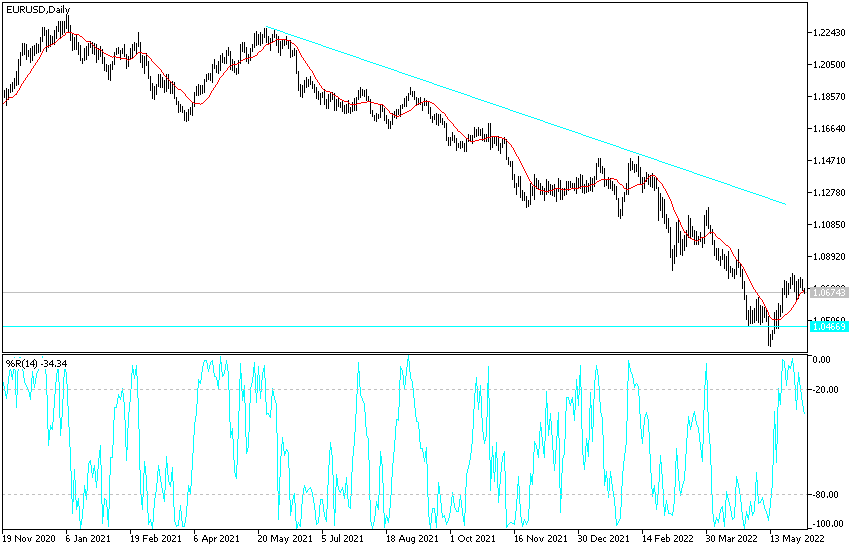

According to the technical analysis of the pair: As mentioned before, the discrepancy between the future of raising interest rates from the Federal Reserve and the European Central Bank will remain a negative influence on any gains for the EUR/USD pair. In addition, the continuation of the Russian-Ukrainian war and its negative repercussions in particular on the Eurozone. To turn the general trend of the EUR/USD to the upside, the bulls broke through the resistance levels 1.0795 and 1.1000, respectively.

On the downside, if the bears move towards the support levels 1.0625 and 1.0540, the bullish expectations will be affected, and the bearish look will return again.

[ad_2]