[ad_1]

There is no doubt that the renewed gains of the US dollar, especially after the announcement of the strong US job numbers at the end of last week, negatively affected the gold market.

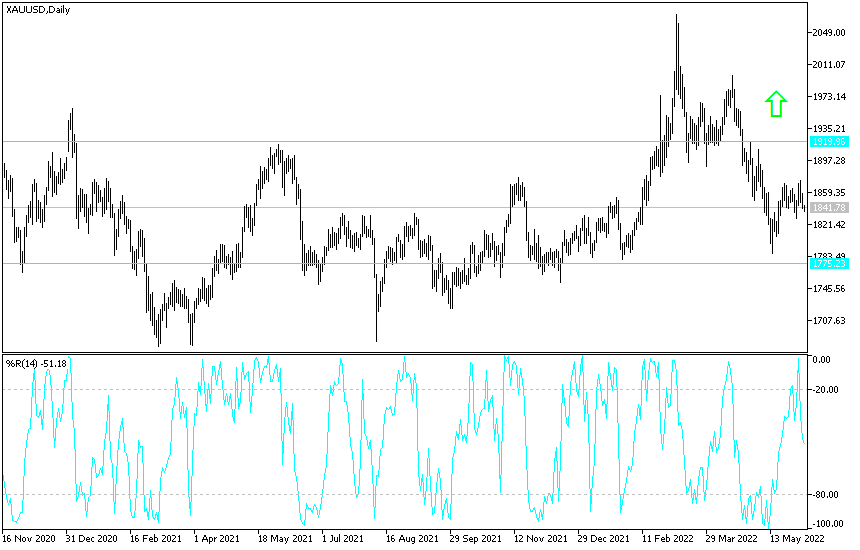

The price of the yellow metal fell to the support level of 1837 dollars an ounce at the time of writing the analysis. The strong dollar is negative for the price of gold, but as I mentioned before that the yellow metal finds momentum from other factors. Factors include global geopolitical tensions led by the continuation of the Russian / Ukrainian war and the survival of Covid 19 in the negative impact on the second economy in the world.

Global stock markets recently rebounded after Beijing’s latest move to ease Covid restrictions boosted speculation that this would help ease supply chain pressures. Meanwhile, the sell-off in Treasuries has sent 10-year yields back above 3 percent, a level not seen since mid-May and potential headwinds for risk sentiment. Stocks struggled to make a sustainable recovery on fears that higher borrowing costs would hurt growth and corporate profits.

Data last week showed that US employment was stronger than expected for the month of May and indicates that the Federal Reserve will not hesitate on its hawkish course to curb price pressures. But the economists at Goldman Sachs Group Inc. They said the Fed might be able to implement its aggressive plan to raise interest rates without pushing the country into recession.

Friday’s US jobs report allayed some fears that the world’s largest economy is slowing too sharply, but also reinforced the view that the Federal Reserve will continue to raise US interest rates to combat inflation. Accordingly, investors bought shares last week, and US stocks witnessed the fourth consecutive week of inflows with the continued rise of the bear market.

On the other hand, the price of crude oil stabilized around $119 a barrel, after Saudi Arabia indicated confidence in demand with higher-than-expected prices in Asia. Meanwhile, the United States is said to be considering allowing more sanctioned Iranian oil to enter global markets to counteract reduced Russian supplies.

Meanwhile, the European Central Bank is set to announce an end to bond purchases this week and officially begin a countdown to raising borrowing costs in July, joining its global peers who are tightening monetary policy in the face of severe inflation. The European Central Bank plans to bolster its support for the weak debt markets in the euro zone if they suffer a sell-off, the Financial Times reported.

According to gold technical analysis: On the daily chart, the price of gold is still moving in its last range, and it will be the closest to new buying levels if it moves towards the support levels of 1828 and 1815 dollars, respectively. On the other hand, the bulls will need to breach the resistance levels of 1875 and 1888 dollars, respectively, to confirm the strong and continuous control over the direction of gold. I still prefer buying gold from every bearish level.

[ad_2]