[ad_1]

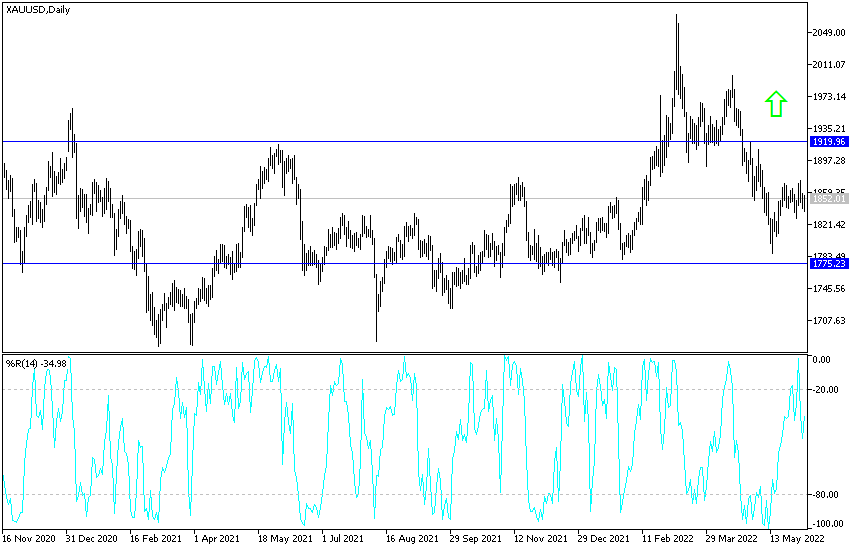

Gold futures posted modest gains yesterday due to weaker US dollar and lower Treasury yields. The price of the yellow metal has been struggling over the past three months due to the Fed’s tightening efforts, which drove up bond yields and strengthened the US currency. Analysts warn that the outlook for gold is bleak, so prices may not be able to touch $2,000 again. The price of gold moved towards the level of 1855 dollars an ounce after it fell to the support level of 1837 countries an ounce in the same trading session.

Gold prices are up 0.7% over the past week and are still up about 1% YTD 2022. In the same way, the price of silver, the sister commodity to gold, is trying to stay above the $22 level once again. Silver futures jumped to $22.195 an ounce. Accordingly, the price of the white metal is looking to recoup more of its losses as silver prices are now down by about 5%.

While gold hasn’t been able to shine as many thought in an inflationary environment, the precious metal has outperformed major benchmarks this year. Commenting on the performance, a team led by Michael Aaron, chief investment analyst at State Street Global Advisors wrote in their mid-year forecast, “From the beginning of 2022 to date, gold has outperformed the S&P 500, by 0.61% by 14.17%, showing its ability to Protection from declines in the stock market.

With financial markets approaching the second half of 2022, market analysts believe that investors can choose to add gold to their portfolios for an element of diversification.

The metals market found support from a weak dollar, with the US Dollar Index (DXY) sliding to 102.36, from the opening of 102.44. The index measures the performance of the US dollar against a basket of currencies. A weaker dollar is good for dollar-priced commodities because it makes them cheaper to buy for foreign investors. Another factor affecting the gold market. US Treasury yields were red across the board, with the 10-year yield falling 7.7 basis points to 2.961%. One-year yields rose one basis point to 2.206%, while 30-year yields fell 7.7 basis points to 3.114%.

Gold is generally sensitive in an appreciation environment because it raises the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures rose to $4.4385 a pound. Platinum futures fell to $1014.70 an ounce. And futures contracts for palladium fell to 1963.50 dollars an ounce.

According to gold technical analysis: The gold market may remain on hold until the announcement of the European Central Bank policy update and US inflation figures, factors that strongly affect investor and market sentiment. On the daily chart, the price of gold is still moving in its last range, and it will be the closest to new buying levels if it moves towards the support levels of 1828 and 1815 dollars, respectively. On the other hand, the bulls will need to breach the resistance levels of 1875 and 1888 dollars, respectively, to confirm the strong and continuous control over the direction of gold. I still prefer buying gold from every bearish level.

[ad_2]