[ad_1]

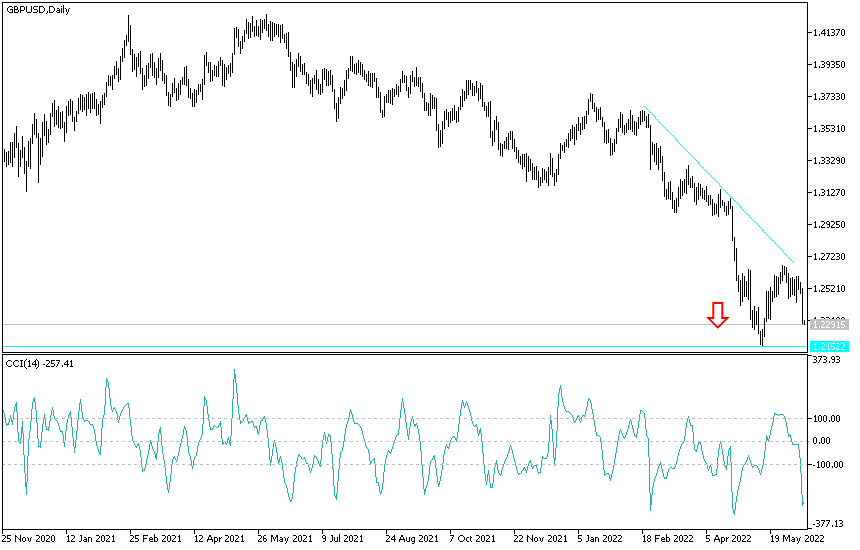

The pound fell against the dollar GBP/USD after US inflation outpaced the Fed’s view of the market. Accordingly, the price of the GBP/USD pair declined significantly, reaching the support level of 1.2301 near its lowest level during 2022. As mentioned before, expectations will increase in strength to move towards psychological support 1.2000 in the event that the bears move in the currency pair towards the 1.2152 support level. The US dollar against the other major currencies gained strong momentum after official data showed that US inflation rose further during the month of May in defiance of market expectations of easing and with potential implications for Federal Reserve policy (Fed). The Bureau of Labor Statistics reported that US inflation rose to 8.6% last month.

This was after the pace of inflation rose on a monthly basis from 0.3% to 1% in May, which led the annual rate to rise further instead of stopping at 8.3% in April, which is what the markets were looking to see. In addition, and most important of all, the most significant rate of core inflation remained unchanged at 0.6% m/m when it was expected to fall to 0.5%, preventing the annual rate of core inflation from falling.

While that left annual core inflation slower at 6.0% (versus 5.9% expected), the slowdown was driven by underlying effects. All in all, this adds upside risk to our current fed funds rate target.

This comes after several Fed policymakers said they would like to see something along the lines of “clear and convincing evidence” that US inflation is not only declining, but also falling squarely toward the bank’s 2% target level.

Separately, and then on Friday, the University of Michigan’s US Consumer Confidence Index fell to an all-time low while the University of Michigan’s survey of inflation expectations for next year rose from 5.3% to 5.4%. The university said that consumer sentiment fell by 14% from May and continued its downward trend over the past year and reached its lowest value on record, compared to the low reached in the middle of the recession of 1980. All components of the sentiment index declined. In summarizing the results of the survey.

The latest US inflation data is the most bullish for the dollar and problematic for the likes of GBP/USD as it feeds into the ongoing upside risks to the previous market’s expectations for Fed interest rates, which were already revised higher after Friday’s announcement. While month-on-month US inflation gauges have looked on the verge of reversing over the previous months, it is likely that any of those hopes were dashed by Friday’s data, which could only mean permanent risks to a steeper trajectory for US interest rates in months. coming.

According to the technical analysis of the currency pair: The bearish performance of the GBP/USD currency pair this week will important, as the US Federal Reserve will announce a half point hike and the Bank of England will announce a quarter point hike. The hawkish signals from one of the two banks will be supportive of one of the two currencies so far. The downside momentum will remain the strongest, and the GBP/USD gains will be subject to selling again. The closest targets for bears are currently 1.2245, 1.2150 and 1.2000, respectively.

On the upside, the bulls will move towards the resistance levels 1.2540 and 1.2660 respectively to cause a change in the current bearish outlook.

[ad_2]