[ad_1]

The strong and continuous signals for the future of raising US interest rates throughout 2022 contributed to the continuation of the bullish momentum of the USD/JPY currency pair towards its highest in 20 years. It tested the 134.73 resistance at the beginning of this important week’s trading, and its gains were reaching the resistance level 134.55. Forex investors do not care about technical indicators reaching overbought levels, as Japan has not defended the collapse of its currency in the recent period.

The Japanese central bank is completely abandoning any sign of tightening its policy as other global central banks are doing. The US Federal Reserve had pledged in May to raise the federal funds rate by 50 basis points at each of its next meetings in June and July, although the risk on Friday was tilted in the direction of the bank continuing to raise borrowing costs through it significantly.

Overall, US Federal Reserve Governor Jerome Powell could provide a hawkish surprise on Wednesday even after effectively pre-announcing a 50 basis point increase in US interest rates at this week’s Federal Reserve meeting and in July. Sharp US inflation data for May reinforced expectations that the Fed will continue to raise borrowing costs at this pace until September, with some investors betting that the Fed chair will provide a significant 75 basis point move unless price pressures subside. Powell could bolster that speculation during his post-meeting press conference by refusing to take 75 basis points off the table — as he did openly last month by saying such a move was not actively considered — or by emphasizing the need for smart policy to cool price hikes.

Friday’s data sent a message that the US central bank has a lot of work to do to contain price pressures. Consumer prices excluding food and energy rose 8.6% in the 12 months through May, accelerating to a 40-year high. After the data was released, investors saw the odds of the Federal Reserve raising interest rates by three-quarters of a percentage point in July, while economists at Barclays plc changed their rate call to expect such a hike as soon as this week.

The updated quarterly forecasts from the US central bank are also likely to increase the projected path of future hikes and eventual peaks. Officials in March saw rates hit 1.9% this year and peaked at 2.8%, according to median estimates. A Bloomberg survey of economists – conducted before consumer price data for May was released – showed expectations advancing to 2.6% this year and 3.1% in 2023.

The Fed will be the highlight of a big week for global central banks. The next day, the BoE is also likely to raise interest rates and is likely to discuss a half-point move, and on Friday the BoJ will make its own decision at a time when the weak yen is proving increasingly difficult to prepare.

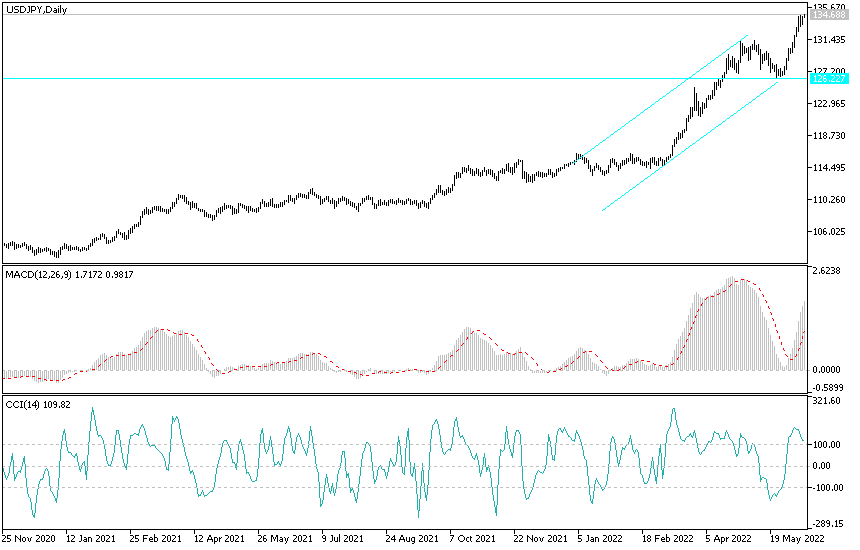

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the USD/JPY currency pair, as the general trend is still bullish, and it may maintain its gains around the highest in 20 years until the US Central Bank announced on Wednesday the closest targets for the bulls. According to the current performance, the resistance levels are 134.85, 135.20 and 136.00, respectively.

On the other hand, according to the performance on the daily chart, it will be important to break the support level 130.65 to start the bears’ control.

[ad_2]