[ad_1]

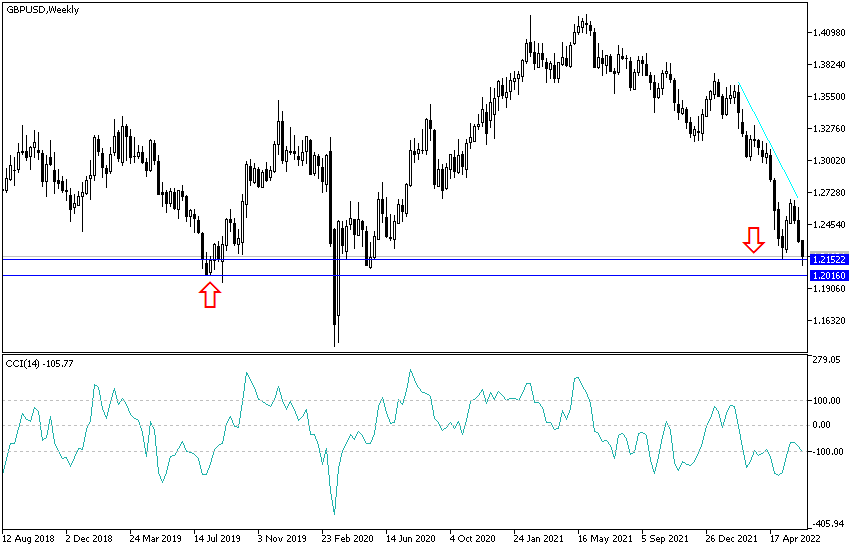

The GBP/USD exchange rate has entered the new week’s trading as it is healing fresh wounds near two-year lows. It will risk further heavy losses in the coming days without a “hardcore” surprise from the Bank of England (BoE) or the prospect of unexpected patience by the Bank of England. GBP/USD losses reached the 1.2106 support level, the lowest in two years, before settling around the 1.2165 level at the time of writing the analysis.

The currency pair fell sharply on Friday when US inflation figures warned that the path back to the Federal Reserve’s 2% target would likely include a longer and more difficult journey than parts of the market had previously anticipated. This comes after headline inflation jumped 1% in May and core inflation remained unchanged at 0.6% m/m when it was expected to fall to 0.5%, which could have implications for the extent to which the inflation rate is. Accordingly, the Federal Reserve will raise the US interest rate this week and in the coming months

Last Friday’s data sent up US bond yields that lifted the dollar and weighed on stock markets around the world as well as many other currencies, and it was likely another watershed moment for Fed policy makers ahead of Wednesday’s interest rate decision. “The increase in short-term yields is fueling a renewed tightening of financial conditions that are likely to continue to support the dollar this week with focus on the FOMC meeting on Wednesday,” said Derek Halpini, head of global markets research at MUFG.

Market participants will be watching closely for updated guidance on the path for further tightening. According to experts, the updated dot chart may indicate that the Fed plans to raise US interest rates by more than the neutral zone in the coming years to combat the risks of bullish inflation.

In this regard, some Fed policymakers have suggested in recent weeks that they may feel comfortable slowing the pace of rate hikes if core inflation begins to decline convincingly, and Friday’s data indicated that point is still a bit off. This, in turn, suggests that the bank may have to deal with the interest rate more than many have anticipated so far in order to bring inflation back to the 2% target.

According to the technical analysis of the pair: the bears controlling the performance of the stronger GBP/USD currency pair and heading to the psychological support 1.2000 is not far away. All pressure factors on the sterling will support the move towards this support, and the currency pair may remain under pressure until the markets react to the decisions of the central bank US tomorrow. Growth and jobs figures in Britain increased the suffering of the sterling against the rest of the currencies.

In case the currency pair moves to rebound higher, the resistance levels may be 1.2220, 1.2300 and 1.2385, the closest if this happens, and in general, the stronger general trend is still to the downside.

[ad_2]