[ad_1]

Longer term, I believe that the euro will reach parity, especially as we have almost no reason to think that in the longer term the Federal Reserve is going to change its overall attitude.

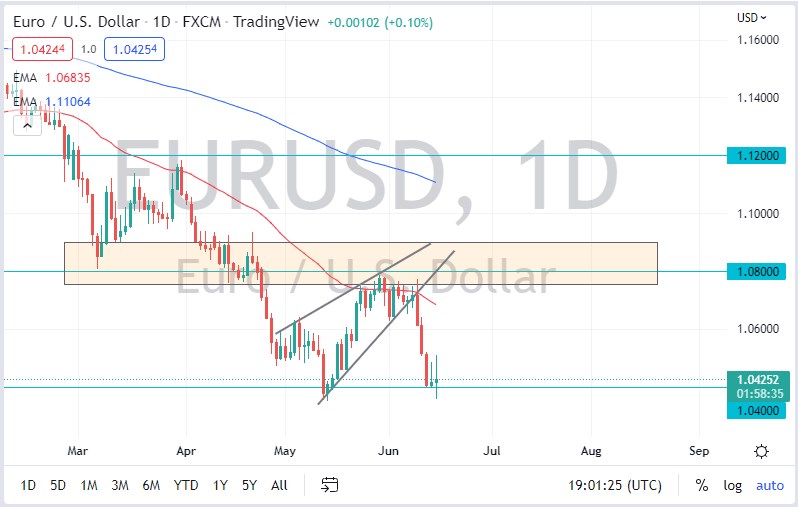

The euro went back and forth on Wednesday as the 1.04 level has offered a little bit of support. Initially, the ECB had gotten involved in the markets by opening up a potential can of worms by having an emergency meeting. However, nothing came out of it other than the ECB suggesting that the central bank would “do something” to keep interest rates down. That’s a strange way of saying quantitative easing, but at the end of the day we had more people focusing on the Federal Reserve and what it was going to do/say.

Ultimately, this is a market that I think continues to see a lot of noisy behavior, but a rally at this point should only open up a nice selling opportunity as the US dollar has been so strong for so long. The euro is going to continue to see a lot of volatility around it, and a bounce here does make a certain amount of sense because we had fallen so far previously. We have hit the suggested target from the falling wedge, so now the market may take a bit of a breather. Nonetheless, if we can break down below the lows that we just made, then it’s possible that we will go down to the 1.02 level.

Longer term, I believe that the euro will reach parity, especially as we have almost no reason to think that in the longer term the Federal Reserve is going to change its overall attitude. After all, inflation is very high in the United States, so the Fed will have to do everything it can to fight that battle. Jerome Powell even suggested that the next several central bank meetings are likely to feature interest rate hikes, so the United States dollar should continue to see plenty of interest.

Part of this may have been a bit of a relief rally for the euro, but I do think that in the longer-term the trends in all of the markets should continue to be intact. Quite frankly, this should give us an opportunity to follow the same trends, after the market comes down and gives it a bit of a rethink. In fact, it’s not until the Euro breaks above the 1.09 level that I would look at this as a change in trend.

[ad_2]