[ad_1]

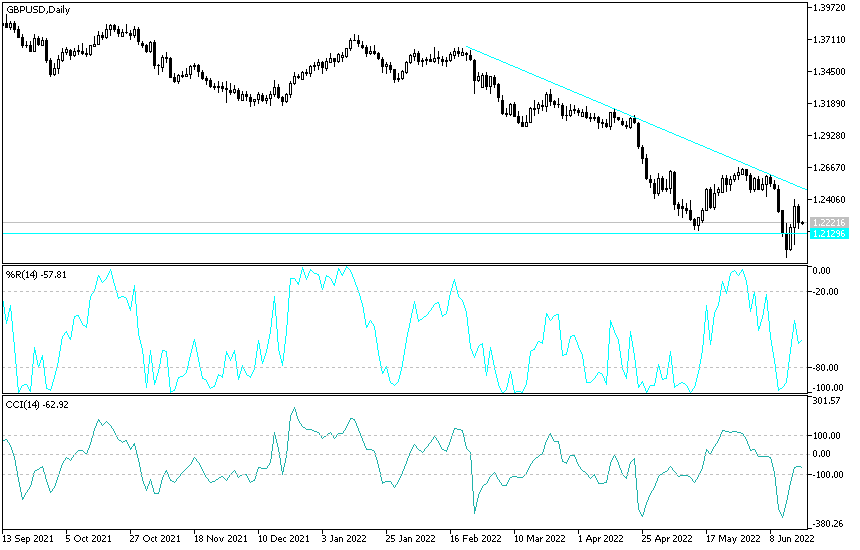

The highlight of the sterling this week will be the release of British inflation data on Wednesday although the retail sales reading on Friday will also be highly anticipated. It is the global market trends that will ultimately determine the direction of the sterling over the coming days. During the last week’s trading, the GBP/USD exchange rate rebounded to the resistance level of 1.2406. Below this level we recommended to our valued clients to sell the currency pair and the GBP/USD pair fell to the level of 1.2172 and settled around the level of 1.2220 at the time of writing the analysis.

The important UK data comes days after the Bank of England raised interest rates by 25 basis points but warned that bigger and more hikes could occur over the coming months if the data warranted it. Therefore, the British pound initially fell on the initial announcement of a 25 basis point hike as markets thought it was justified due to high inflation, but it rose as it became clear that the British Central Bank is likely to be more aggressive in the future as it prioritizes the end of inflation targeting on GDP growth management.

The main takeaway from last Thursday’s BoE policy update is that the data is important, so next Wednesday’s inflation numbers will be of great interest. Britain’s core CPI inflation is likely to rise 0.2 point to 9.1% y/y in May, the highest level since records began in 1989. Core inflation is likely to rise 0.1 point to 6.3% y/y. This means that the UK now has a hotter core CPI than the Eurozone or the US. A big win in these headline numbers could push UK bond yields higher as investors anticipate further hikes in bank interest rates, helping the GBP exchange rates in tandem.

Meanwhile, UK PMI numbers on Thursday will give the first major snapshot of how the UK economy will perform in June. Markets are looking for the composite PMI component of the PMI due to read at 51.8, unchanged in May. The manufacturing PMI is expected to come in at 54.6 and the all-important services PMI at 53.0, down from 54.6 in May.

Britain’s retail sales on Friday will give insight into how consumers are reacting to rising inflation and are expected to have contracted 0.9%m/m in May, down from the 1.4% growth rate recorded previously. A strong set of BOE retail numbers will indicate that inflationary pressures will continue to rise as strong demand will only encourage businesses to pass on cost pressures.

Prior to the data, the pound sterling against the euro was seen at 1.17 after declining by just 0.10% last week while the pound sterling against the U.S. dollar was down at 1.2284 after dropping just a third of a percent. Global market sentiment will also be a major determinant of where the GBP moves as this is a pro-cyclical currency that tends to rally support during times of global economic recovery. Last week saw some major US indexes officially fall into a bear market, which means that the Pound’s backdrop remains tough as further stock losses are more likely than none.

According to the technical analysis of the pair: Expectations of the possibility of moving the price of the GBP/USD currency pair to the 1.2000 psychological support level may return to the fore if it returns to stability below the 1.2170 support level again. According to the performance on the daily chart below, the general trend of the GBP/USD is still to the downside. In the same time period, there will be no opportunity to break the general trend without moving above the resistance 1.2585, otherwise the general trend will remain bearish.

The currency pair does not expect important and influential data today, and investor sentiment will have the strongest and direct impact.

[ad_2]