[ad_1]

We often recommend buying gold from every descending level with quick deals and taking advantage of the continuous rebounds every time the price of gold declines.

Gold futures ended the tumultuous trading week lower as the brunt of the financial market sell-off came on the yellow metal. Gold prices not only closed the session lower, but also recorded a weekly decline. This was mostly driven by the appreciation of the US dollar as investors flocked to the safe-haven traditional assets. With the Federal Reserve raising US interest rates, it will be even more difficult for gold.

Accordingly, the price of gold fell to the support level of 1815 dollars per ounce and recovered during the Friday trading session to the level of 1853 dollars per ounce. This was before closing the week’s trading around the level of 1840 dollars per ounce, and this week’s trading started stable around the level of 1838 dollars per ounce. All in all, gold prices posted a weekly loss of about 2%, shrinking their annual gains to less than 1%. Over the past 12 months, gold is still up more than 4%.

As for the price of silver, the sister commodity to gold, it also ended Friday’s trading session lower as it could not stay above the $22 level. Silver futures fell to $21.63 an ounce. The white metal recorded a weekly loss of 1.35%, which increased its decline since the start of the year 2022 to date by more than 7%. Over the past 12 months, silver prices have fallen by more than 16%.

The main reason for gold’s decline last week was the US dollar, which continued its strong performance in 2022. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 104.65, from its opening around 103.63. The index posted a modest weekly gain of 0.48%, extending its YTD hike beyond 9%.

In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

Another factor affecting the gold market. The Treasury market was mostly in the red, with the benchmark 10-year Treasury yield down 7.4 basis points to 3.231%. The one-year bond yield slipped to 2.86%, while the 30-year yield fell 7.9 basis points to 3.282%.

The gold market is usually sensitive to a price appreciation environment because it increases the opportunity cost of holding bullion that is not yielding.

All in all, it has been a reckless week in both gold and global financial markets. From weak economic data to a stronger dollar to the Federal Reserve getting bolder to fight inflation, gold has been trying to absorb everything that has happened. This may explain why gold prices have fluctuated throughout the trading week. Market experts also believe that there may be a renewed demand for gold amid fears of a recession. The dreaded “r” has become the primary scenario for many on Wall Street as the US central bank attempts to tame inflation through a series of interest rate increases.

Some recent economic data painted a bleak picture for the US economy. Industrial production rose by only 0.2% while industrial output decreased by 0.3%. Earlier this week, US retail sales also fell 0.2%, the number of Americans filing for unemployment benefits increased, and housing demand waned.

As for other metals markets, copper futures fell to $4.0115 a pound. Platinum futures fell to $929.20 an ounce. Palladium futures fell to $1,795.50 an ounce.

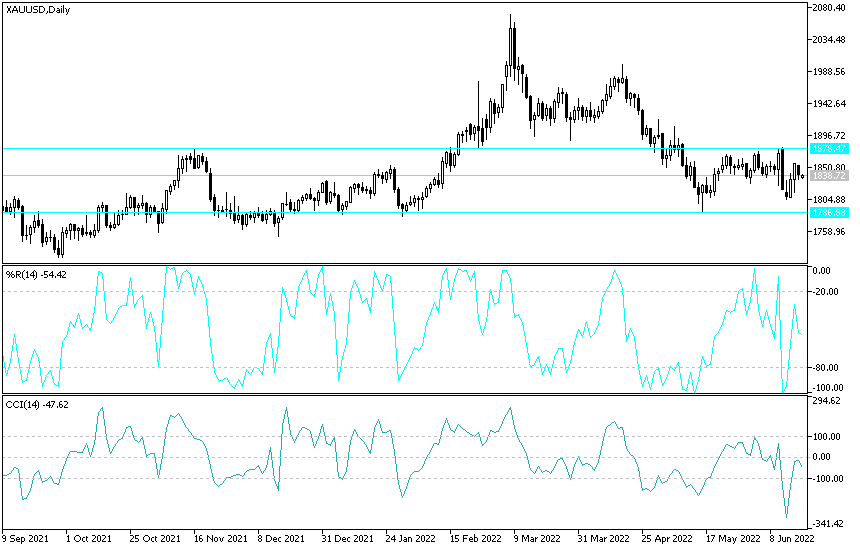

According to gold technical analysis: The price of gold is trying to remain in the neutral zone with a relatively upward tendency, as is the performance on the daily chart below. I have often recommended buying gold from every descending level with quick deals and taking advantage of the continuous rebounds every time the price of gold declines. I still see that the gold market receives momentum from the continuation of global geopolitical tensions and the world’s fears of economic stagnation in light of the global central banks’ strong tendency towards raising Interest rates to contain record inflation.

Accordingly, the bulls may return to control the direction of gold if it moves towards the resistance levels of 1865 and 1878 dollars, respectively. There will be no change to a strong bearish trend without a breach of the $1800 support level for an ounce.

[ad_2]