[ad_1]

Japanese officials, whether from the government or the Central Bank of Japan, still abandoned commenting on the Japanese yen’s collapse to its lowest level in 24 years. It brought the USD/JPY currency pair strong and continuous upward momentum. The currency pair’s gains brought it to the resistance level 136.70, the highest in 24 years, and stable around it at the time of writing the analysis. This is at a time when the US dollar pairs are awaiting the testimony of US Federal Reserve Governor Jerome Powell today and tomorrow.

Forex traders have been wondering recently: Where will the collapse of the Japanese yen continue?

In response, according to Nouriel Roubini, an additional 10% decline in the yen rate would be enough to trigger a change in BOJ policy. CEO Roubini Macro Associates told Bloomberg Television at the Qatar Economic Forum on Tuesday that the yen will continue to fall thanks to the discrepancy in the political stance between the dovish Bank of Japan and the hawkish Federal Reserve. He said that this would lead to an inflation problem for the Bank of Japan and would lead the BoJ to abandon the zero rate policy and yield curve control program.

Roubini is known for his insight regarding the 2008 financial crisis.

Roubini added: “If the dollar-yen rate crosses the 140 mark, the Bank of Japan will have to change its policy and the first change in policy will be to control the yield curve.” “So I think another 10% drop in the Japanese yen would mean a change in policy.”

The Japanese yen has fallen about 15% this year.

Stuck between the Bank of Japan keeping interest rates on the ground to boost the domestic economy and the US Federal Reserve aggressively to rein in high inflation, the yen fell to a 24-year low against the dollar. Speculators have upped their bets on the possibility that the Bank of Japan will eventually have to change course for its ultra-easy monetary policy, something that doubled down on its meeting last week.

Roubini added that while some in the market were speculating about official intervention to stem the currency’s decline, exacerbating price hikes for consumers and businesses, such an action would be a waste without changing central bank policy. “If you have intervention in the forex market without a change in monetary policy by the Bank of Japan, the intervention will not be enough to stop the yen’s decline,” he added.

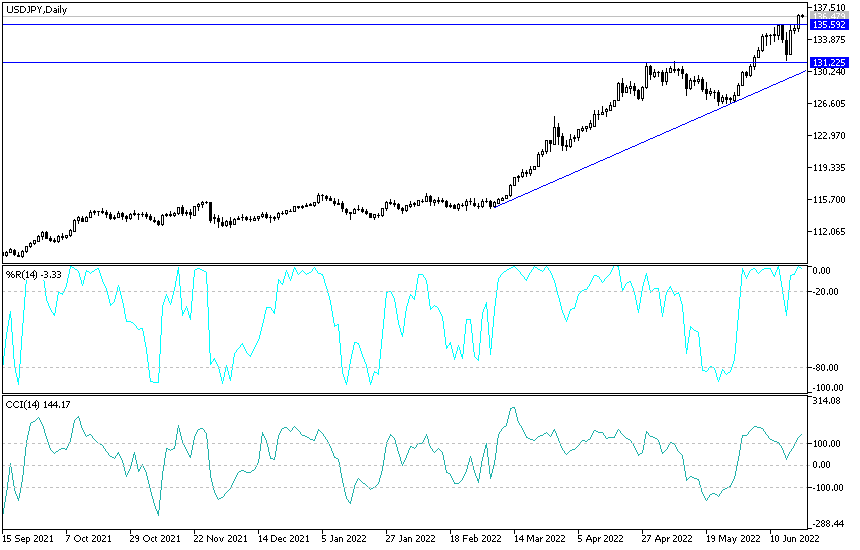

USD/JPY Technical Outlook:

The general trend of the USD/JPY currency pair is still bullish. As I mentioned before, forex investors do not care about the arrival of technical indicators towards overbought levels after the recent gains. The continuation of the above-mentioned factors ensures that the bulls continue to control the performance. The closest targets to the current trend are the resistance levels 137.65 and 138.80, then the psychological resistance 140.00, respectively. On the other hand, according to the performance on the daily chart below, the first breakout of the trend will be the breach of the 130.00 psychological support. The reaction from Jerome Powell’s testimony today will have the strongest impact on the performance of the currency pair.

[ad_2]