[ad_1]

SOL/USD is trading near short-term highs in early trading this morning, and the ability of Solana to produce rather quick results on speculative wagers can prove enticing.

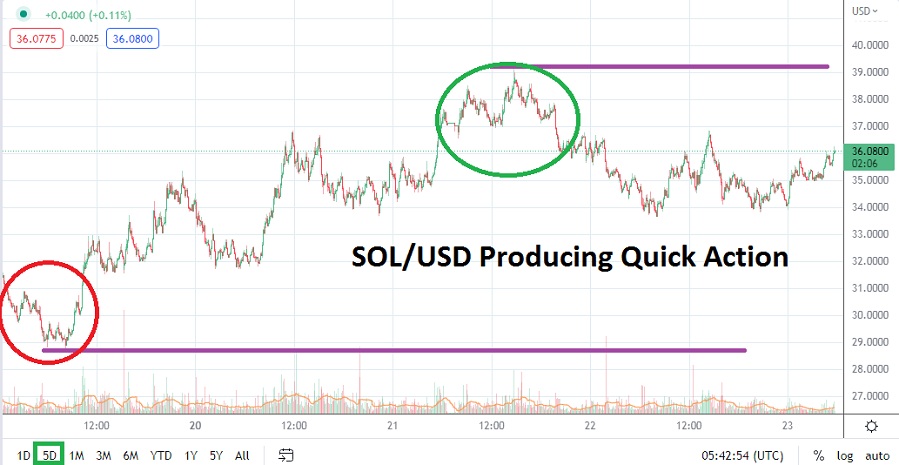

SOL/USD is trading near short-term highs as of this morning near the 36.0000 ratio. On the 21st of June SOL/USD did trade above the 39.0000 mark, this reversal higher was achieved after the cryptocurrency traded near the 28.6500 vicinity on the 19th of June. Solana has mirrored the major digital asset marketplace and has suffered a strong bearish trend. However, SOL/USD continues to offer speculators a place to look for quick trading results which could attract those who like fast wagers.

Entry price orders should certainly be used when pursuing movement in SOL/USD. A live market order in SOL/USD is an open invitation to receive an unexpected price fill which could deliver a rather difficult trading path for a speculator.

While SOL/USD trades near short-term highs momentarily, traders may feel inclined to seek downside momentum which aims for nearby support levels. Because of the speed which Solana trades, speculators are also urged to use take profit and stop loss orders too, this so market action doesn’t escape trading targets in a dramatic fashion.

SOL/USD has been able to produce a rather stimulating move upwards the past handful of days after falling to its lower depths. The move higher however, also occurred as the major counterparts of Solana were able to produce some buying power. Nervous sentiment remains abundant in the cryptocurrency marketplace and speculators who believe additional upside can be found beyond current resistance levels may want double check their perceptions.

36.8000 looks to be a rather solid resistance level for short term traders, if it is not toppled this may send a negative signal to traders. If the 36.0000 juncture cannot be passed and sustained, this may ignite selling in SOL/USD. Trading conditions in Solana dictate that conservative amounts of leverage are needed to make sure moves that go against the chosen direction of the trader doesn’t wipe out their account with a single adventure.

Support levels of 35.5000 to 35.000 should be monitored in the short term. If these support ratios start to look vulnerable, SOL/USD could quickly find that it is testing the 34.8000 ratio. If this lower value proves vulnerable this would likely indicate another downward dose of selling is taking hold and it could produce a near term move below the 34.0000 mark.

Solana Short-Term Outlook

Current Resistance: 36.8500

Current Support: 34.9000

High Target: 38.6000

Low Target: 33.6000

[ad_2]