[ad_1]

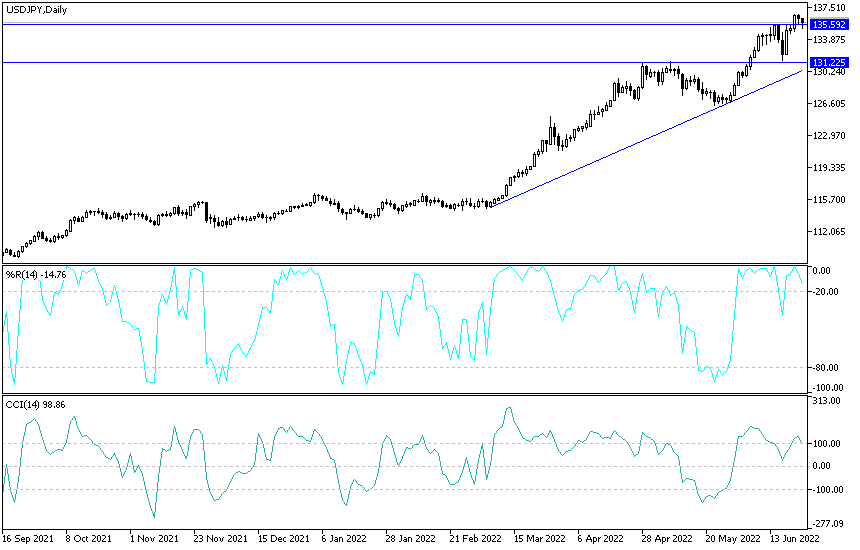

The record bullish breakouts of the USD/JPY currency pair do not stop, and reached the resistance level of 136.72, the highest for the currency pair in 24 years. The Japanese officials’ failure to intervene despite the recent and continuing collapse of the Japanese yen price gives the currency pair the impetus for more upward movement. The price of the dollar / yen is stable at the level of 135.20 at the time of writing the analysis. Yesterday, US Federal Reserve Governor Jerome Powell said in the text of his semi-annual testimony before the Senate Banking Committee. The central bank will continue to raise US interest rates to tame inflation after its highest rise in nearly three decades, although policymakers must be “agile” as various shocks hit the world’s largest economy.

“We expect continued increases in interest rates to be appropriate,” he added. “It is clear that inflation has surprised the upward trend over the past year, and there could be more surprises in store. So we will need to be smart in responding to incoming data and evolving forecasts.”

Powell’s largely prepared remarks echoed comments at a news conference last week after he and his FOMC colleagues raised the benchmark lending rate by 75 basis points – the largest increase since 1994 – to the 1.5% to 1.75% range. While Powell told reporters last week that another 75 basis point increase, or a 50 basis point move, was on the table for the next meeting in late July, yesterday’s text did not indicate the size of a future rate hike. Fed Governor Christopher Waller said on Saturday that he would support a 75 basis point interest rate increase in July if economic data came out as expected.

“We understand the difficulties that high inflation creates,” Powell added in his testimony. And “we are deeply committed to bringing inflation back down, and we are moving quickly to do so.”

Economically: The US Consumer Price Index rose 8.6% last month compared to a year earlier, the highest level in four decades. Recently, the rising cost of living angered Americans and hurt the standing of US President Joe Biden Democrats with voters ahead of the mid-term congressional elections in November. Fed officials have admitted that they have been too slow to tighten and are now trying to increase the front-loading rate on the most aggressive policy axes in decades. While a recession is not in the Fed’s forecast, economists are increasingly raising the bar for an economic downturn sometime in the next two years.

In this regard, former New York Fed President Bill Dudley said in a Bloomberg opinion column on Wednesday that a recession is “inevitable” within the next 12 to 18 months. The risk of a significant increase in the unemployment rate exceeds 50% over the next four quarters, Fed economist Michael Kelly said in a paper on Tuesday, based on simulations that include inflation, unemployment data and corporate and Treasury yields.

“The US economy is very strong and well-positioned to deal with a tighter monetary policy,” Powell added.

USD/JPY analysis:

There is no change in my technical view of the price performance of the USD/JPY currency pair. The general trend is still bullish, bearing in mind that the recent gains are sufficient to push the technical indicators towards overbought levels. However, the currency pair’s gains factors continue and warn of a strong bullish move in the coming days. It is headed to move towards the standard psychological resistance level of 140.00, which is the level that officials in Japan have indicated that they may move to intervene if the currency pair reaches it. On the downside and according to the performance on the daily chart, there will be no actual reversal of the trend without breaking the 130.00 support level, otherwise the bulls will continue to dominate.

[ad_2]