[ad_1]

Start the week of June 27, 2022 with our Forex forecast focusing on major currency pairs here.

The yen is a popular asset during turbulent times.

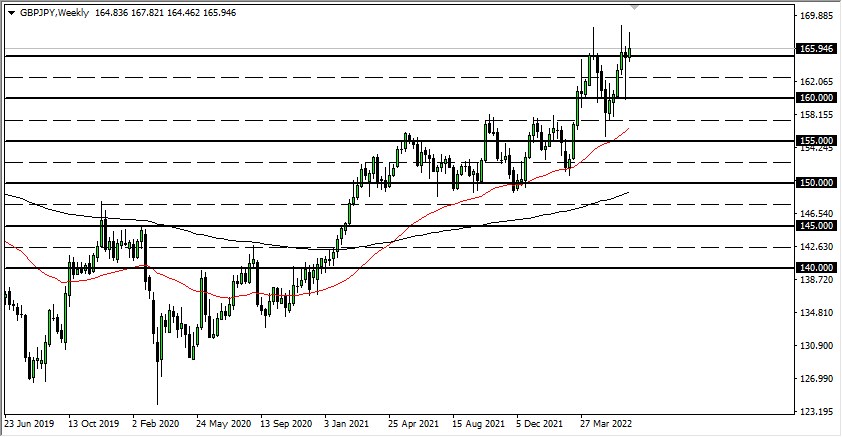

GBP/JPY

The British pound initially spent most of the week going higher against the Japanese yen but has continued to struggle near the ¥168.50 level. That being said, I think based on the candlestick from both this past weekend and the one before it, it’s likely that we will continue to hear a lot of noise. Ultimately, we are in an uptrend, and as long as the Bank of Japan is going to continues to fight interest rates, that will put downward pressure on the Japanese yen, thereby allowing this market to continue cranking higher as it has been. Ultimately, this is a market that I think will show signs of value hunting on every dip.

USD/JPY

The US dollar has skyrocketed against the Japanese yen over the last several months, but this week started to see a little bit of selling pressure. That being said, I think it’s just some profit-taking going on, and this is still a situation that you need to look at through the prism of finding value. Eventually, we will get some type of pullback that allows for that value, and I would be interested in buying it. Of special interest would be the ¥132.50 level. I have no interest in shorting this market anytime soon, and I believe that the ¥130 will be an even more supportive area.

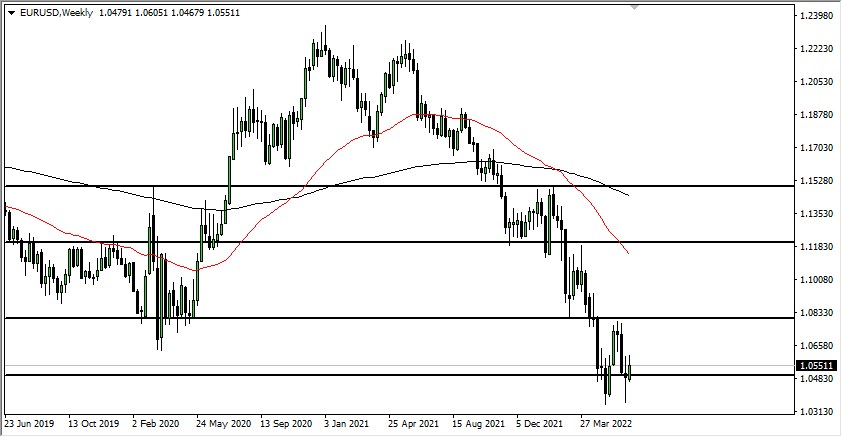

EUR/USD

The euro has rallied during the course of the week, as we continue to see the 1.04 level offer a certain amount of support. This is a market in which I think you can continue to fade rallies, as the Federal Reserve is tightening its monetary policy going forward. On the other side of the equation, the ECB might tighten a bit, but it’s going to pale in comparison to the Federal Reserve as the United States is more worried about fighting inflation than finding energy such as the European Union.

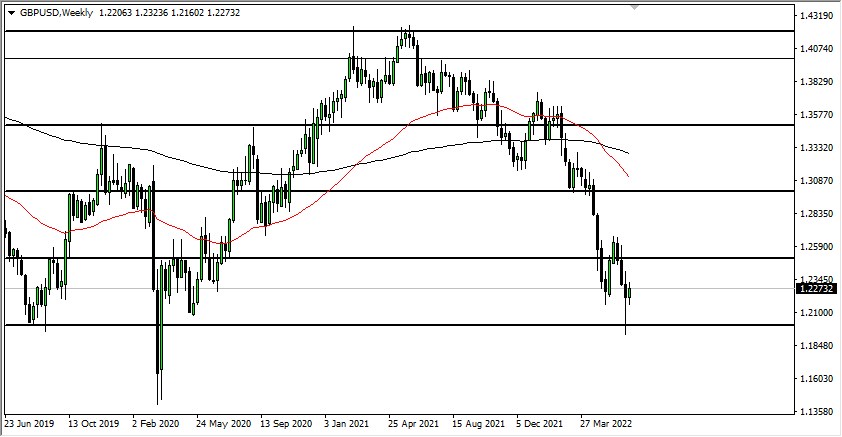

GBP/USD

The British pound has been somewhat noisy during the course of the week as we are trying to find some type of bottom. Even if we do rally at this point, it’s likely that the 1.25 level is an area where a lot of people will find sellers, and I do think that you will continue to fade rallies going forward, but we may have a little bit to go before we get to serious selling pressure. Underneath, the 1.20 level is the target.

[ad_2]