[ad_1]

Gold futures retreated from the gains that coincided with the beginning of trading this week, with the yellow metal entering the negative territory throughout the year. Metal commodities suffered a broad sell-off amid recession fears. With stocks still in a bear market and inflation high, will investors return to traditional safe assets?

Yesterday, the price of an ounce of gold jumped to the level of 1841 dollars, and then returned to the level of 1821 dollars an ounce today. In general, gold prices fell by about 1% during trading last week, which increased its losses since the start of the year 2022 to date to about 0.3%. The yellow metal is on track for a monthly decline of at least 1%. Also, silver, the sister commodity to gold, was trading relatively flat at the start of the week’s trading. Silver futures rose to $21.145 an ounce. The white metal comes out of a weekly loss of more than 2%, in addition to its decline since the start of the year 2022 to date by nearly 10%.

Despite the weak US dollar, investors are reacting to higher Treasury yields. In addition, investors are keeping an eye on the latest geopolitical developments after the Group of Seven nations will soon ban imports of Russian gold. US President Joe Biden announced Sunday that the Group of Seven will prevent the import of Russian gold, while the British government confirmed to the media that these countries agreed to the ban.

Investors do not believe that this will have any material impact on the economy because its contribution to the global metals market is minimal. Many countries with huge gold reserves and huge mining infrastructure will be willing to step in and make up the shortfall. However, Moscow contributed the second highest level of gold, totaling 330 tons in 2021.

Meanwhile, the dollar weakened on Monday, with the US Dollar Index (DXY), a measure of the US currency against a basket of major currencies, falling to the 103.91 level, down from an opening at 104.19. The index is emerging from a weekly decline of 0.7%, reducing its annual rise to 8.2%.

A weak dollar is beneficial for dollar-priced commodities because it makes it cheaper for foreign investors to buy them.

The US Treasury market was positive, with the benchmark 10-year bond yield rising 7.5 basis points to 3.2%. The two-year bond yield rose 7.5 basis points to 3.132%. Therefore, the spread between the two debt instruments was less than seven basis points, which is critical to market analysts because a reversal could signal a recession. However, gold is sensitive to the environment of higher prices because it causes it to raise the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures rose to $3.751 a pound. Platinum futures rose to $904.80 an ounce. Palladium futures rose to $1,861.50 an ounce.

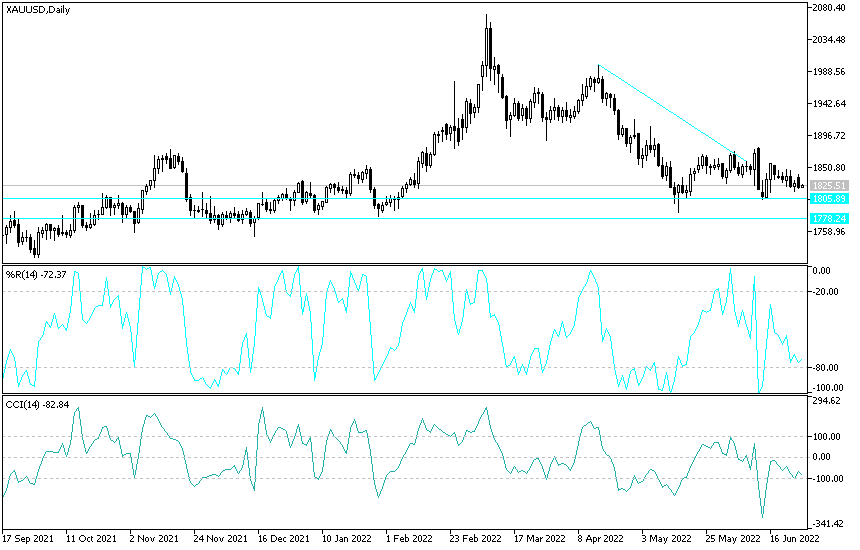

Gold price forecast today:

The gold price is still moving within a downward correction, and the bears’ control of the trend will be strengthened if the gold price moves to the support levels of 1815, 1800 and 1785 dollars, respectively. All in all, I still prefer buying gold from every bearish level. On the other hand, the bulls will return to control the trend if the gold price moves towards the resistance levels 1855 and 1877, respectively. Technical indicators are in a neutral position with a bearish slope.

[ad_2]