[ad_1]

There’s no realistic scenario in which I am a buyer as things stand currently.

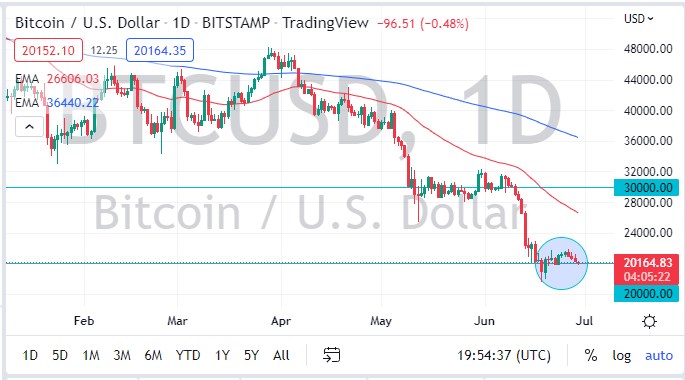

Bitcoin had a relatively quiet session on Wednesday as we are hanging just above the $20,000 level, an area that of course is a large, round, psychologically significant figure. The market breaking down below that level could open up quite a bit of fresh selling pressure and kick off the next leg lower. Ultimately, if we break down below the $18,000 level, this thing could start falling apart yet again.

Keep in mind that there is a line of downward pressure to begin with, and if we were to break down below the $1800 level, the market will probably try to pick up the $16,000 level, possibly even lower than that. From a longer-term standpoint, the technical analysis suggests that we could drop to the $12,000 level. The $12,000 level is an area that is important from the past breakout, and it was where we kicked off this bullish run that the market is currently destroying.

Looking at this chart, it’s obvious that we are very much in a downtrend, and it would be difficult to see this as a bullish setup unless we clear the $30,000 region. That essentially means we need to gain 50% before we can even start to talk about Bitcoin being remotely bullish. With the tightening monetary policy in the United States and the fact that everything is being sold off currently, I just don’t see how a risk asset such as Bitcoin attracts a lot of inflow. The Bitcoin market will continue to be noisy, and of course, it will get the occasional rally. That being said, we have a long way to go before Bitcoin builds enough of a base to be attractive, so I think what we are hoping to see is some type of breakdown followed by a couple of months of consolidation. I think this is very likely going to end up being much like the last crypto winter, meaning that we will go sideways for a while, while people continue to accumulate. If we get down to the $12,000 level I will start accumulating, but I think we have plenty of time to do that. There’s no realistic scenario in which I am a buyer as things stand currently. However, if that changes I’ll be the first to let you know here at DailyForex.

[ad_2]