[ad_1]

The euro narrowly avoided a move towards the psychologically important level of parity against the dollar in the last session of trading last week. However, it was last seen struggling to fend off a dollar rally after US nonfarm payroll numbers on the upside surprised market expectations for June. The price of the EUR/USD fell last week to the support level 1.0071, the lowest since 2002, and closed the week’s trading around the support level 1.0183.

According to official figures, non-farm payrolls in the United States increased last month when about 372,000 jobs were created either by the economy or simply recovered from the damage caused by previous coronavirus containment efforts, which was far exceeding the 260,000 increase indicated by the measures consensus among economists. Meanwhile, the country’s unemployment rate stabilized at 3.6% in June, staying close to its lowest level in several decades before the outbreak of the pandemic.

The US unemployment rate stood at 3.6% for the fourth consecutive month, and the number of unemployed was essentially unchanged at 5.9 million in June. These measures differ slightly from their values in February 2020 (3.5 percent and 5.7 million, respectively), before the coronavirus (COVID-19) pandemic, the Bureau of Labor Statistics said.

However, the office added: “Total non-farm employment is down 524,000, or 0.3 percent, from the pre-pandemic level in February 2020.”

Average hourly earnings growth came in at 0.3% last month and 5.1% for the year to the end of June, which is potentially significant to the Fed’s forecast and reverses declines from 0.4% and 5.3%, respectively. Wage growth did not match the pace of inflation in the US, which was more than 8% on a single scale for the month of May, but it was on higher than usual levels and central banks usually interpret this as fueling inflation and a call for higher interest rates.

The market has already assessed the risks of the fed funds rate rising 0.75% to 2.5% this month, but that didn’t stop the dollar from rising or the euro from falling in the wake of Friday’s data. One possible explanation for Friday’s data and the dollar’s response to it is that the post-pandemic US labor market is in good shape and likely only adds to the ongoing upside risks to the Fed’s interest rate outlook.

This comes after the June monetary policy meeting minutes were explicitly announced “with the awareness that a more restrictive stance may be appropriate if high inflation pressures persist”. There was broad support at the FOMC in June to raise US interest rates to a “moderately restrictive” level of 3% to 3.5% by the end of the year, but Fed officials have since made clear that they will be ready for that.

“At the current stage, with inflation remaining well above the committee’s target, participants noted that a transition to a restrictive policy stance is required to fulfill the committee’s legislative mandate to promote maximum employment and price stability.” In addition, such a position would be appropriate from a risk management perspective as it would put the Committee in a better position to implement a more restrictive policy if inflation comes in higher than expected.”

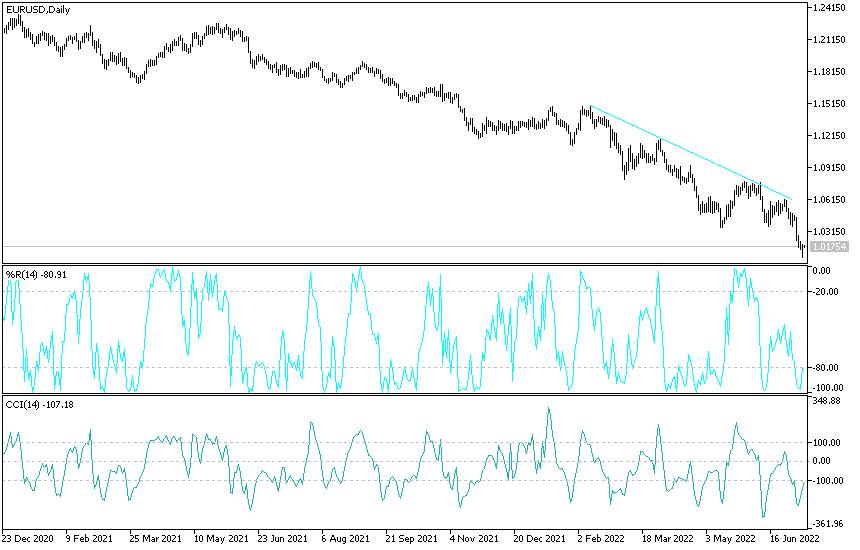

Technical analysis of the EUR/USD pair

In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of a limited ascending channel. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls are looking to ride the current bounce towards 1.0209 or above to 1.0243 resistance. On the other hand, the bears will target short-term profits at around 1.0140 or lower at 1.0106.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.0056 or lower to the 0.9915 support. On the other hand, the bulls will look to pounce on long-term profits around 1.0282 or higher at the 1.0448 resistance.

[ad_2]