[ad_1]

The yen is a popular asset during turbulent times.

The demand for the US dollar was strong at the beginning of this week’s trading, amid a decline in global stock markets linked to renewed fears of more Chinese economic problems as a new outbreak of Covid-19 was reported in Shanghai. Accordingly, the price of the USD/JPY currency pair moved for more bullish breaches, as it jumped to the resistance level of 137.75, the highest for the currency pair in 24 years, before settling around the level of 137.50 at the time of writing the analysis, waiting for any news.

The yen is a popular asset during turbulent times.

Investors had hoped China was on its way to easing its Covid-free approach to the virus, but news that areas of Shanghai are undergoing mass testing has led to fears of severe restrictions being imposed again. According to market performance, the dollar was the strongest against a basket of currencies due to global growth concerns. Those concerns were exacerbated by fears of more lockdowns in China after Shanghai reported its first case of the highly contagious BA.5 omicron subtype.

Shanghai reported its first case of variant BA.5 on Sunday and authorities say mass testing for Covid will be conducted twice between July 12 and July 14 in nine regions. Commenting on this, Susanna Streeter, Senior Investment and Markets Analyst, Hargreaves Lansdowne, said: “The uncertain outlook keeps stock markets volatile with growing fears of severe inflation and a global slowdown, while Covid concerns are back again.” And “signs that the story of The Covid horror is not over yet on our nerves.”

Asian and European markets were trading in the red while US stock futures pointed to a softer open. These dynamics reflect an investor environment that tends to favor the dollar and other “safe havens” currencies.

The DXY dollar index – a measure of the dollar’s broader performance based on exchange rates specific to the US dollar – was near its highest level since 2002 at 107.47.

Commenting on this, Mark Heffel, chief investment officer at UBS Global Wealth Management, says: “In the current climate of risk aversion in the markets, the US dollar’s rally is likely to continue in the near term.” But looking to the future, the analyst says, this strength is unlikely to last in the long term. UBS said in a note Monday that the dollar’s rally will be constrained by peak rate hike expectations by the US Federal Reserve as investors begin pricing in a physical economic slowdown in 2023.

This could prompt the Fed to cut interest rates. Accordingly, some analysts advise investors not to take a position in order to continue the rise of the US dollar. Instead, our favorite safe haven currency is the Swiss franc. We also favor commodity currencies, which we expect to benefit as commodity prices recover from the recent decline.

Overall, the selling of the Japanese yen accelerates after Japan’s ruling coalition expanded its majority in Sunday’s upper house elections, as investors interpreted the result as a near-referendum on the country’s ultra-easy monetary policy. Accordingly, the Japanese currency fell 0.8% against the dollar, surpassing the closely watched 137 level. Bank of Japan Governor Haruhiko Kuroda reiterated on Monday that he would not hesitate to add monetary stimulus if needed to bolster the faltering economy.

Rising Treasury yields and strong US employment data on Friday also gave an additional boost to the dollar, which rose against most of the major currencies. Commenting on the performance, Tsutomu Soma, a bond trader at Monex Inc said: “The environment is vulnerable to dollar buying and yen selling given the sense of security that there will be no turmoil in Japan for a while and amid expectations of a Fed rate hike to combat inflation.” . in Tokyo. “It wouldn’t be surprising if USD/JPY tested 147 or 150 in that direction.”

With the Bank of Japan keeping interest rates on the floor even as foreign interest rates rise, the yen has fallen to a 24-year low, down more than 16% against the dollar this year. The coin is a very short distance from its worst decline ever, according to data compiled by Bloomberg. Japan’s elections came two days after the assassination of former Prime Minister Shinzo Abe, who was seen as a major supporter of the Bank of Japan.

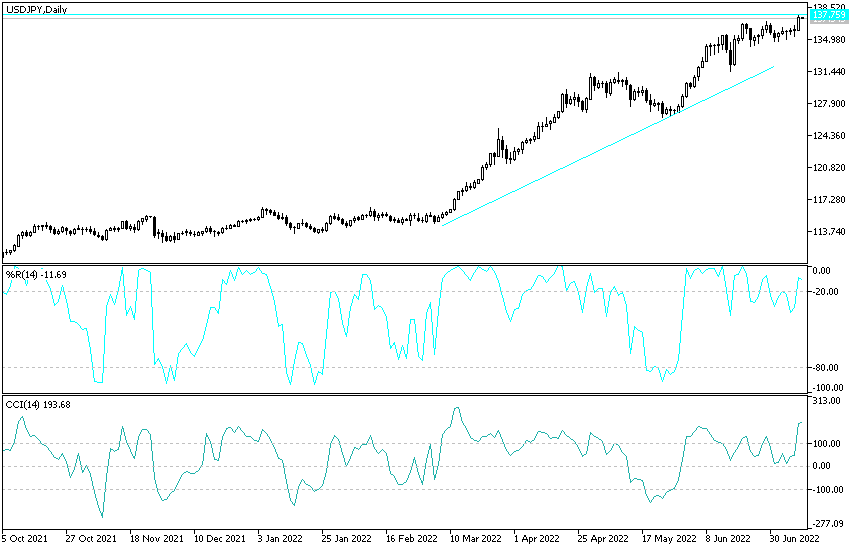

USDJPY Technical Outlook

The general trend of the USD/JPY currency pair is getting stronger towards the upside and stabilizing above the resistance 137.50, which does not rule out moving towards the next psychological resistance level 140.00. The factors of the strength of the US dollar continue, and the Japanese yen did not even benefit from the attempts of investors to buy safe havens. On the downside, if there is profit taking selling, which is expected at any time, the currency pair may move towards the support levels 136.80 and 135.00, respectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]