[ad_1]

New reports of restricted Russian gas supplies to Europe are adding pain to the euro exchange rate. The euro zone’s single currency was among the biggest losers after Russia said there were some problems with another Nord Stream turbine. The news confirms fears that Russia is ready to severely restrict the flow of gas to Europe in response to Europe’s support for Ukraine. Accordingly, the EUR/USD pair was subjected to selling operations that pushed it towards the 1.0100 support level. The most popular currency pair in the forex market is being watched closely today due to important US economic data, led by the US Federal Reserve announcing a new hike in US interest rates to contain record inflation.

The wholesale gas price in the Netherlands over the weekend rose 17% to €192/MWh, and the price of European TTF Cal23 natural gas jumped above €150/MWh, hitting a new all-time high for the decade. Meanwhile, Russia’s latest move to cut natural gas supplies from Europe has intensified global competition for liquefied natural gas, the type of gas supplied in liquid form via tankers. Bloomberg reported that Asian importers are speeding up their plans to buy winter LNG cargoes, fearing Europe will hoard supplies. As a result, LNG prices have soared to mid-$40/MMBtu. Commenting on this, Marius Hadjikyriakos, senior investment analyst at XM.com says: “The risk of Russia cutting off gas completely and crippling powerful economic powers like Germany during the winter is hanging like a sword over the euro.”

Regarding the future, “everything is possible, but it is useful to consider that this is the ‘nuclear’ option for Russia as well,” Hadjikyriakos says. “Europe imports about 35% of its energy from Russia, yet Russia collects about 70% of its energy revenue from the European Union, and this supply is mainly sent through pipelines that cannot be rerouted to Asia,” he explains.

Current Economic Outlook

Gas prices will remain a source of acute concern for markets eyeing Europe in the coming days and months. Thus, more dwindling gas supplies and higher prices will continue to put pressure on the EUR.

In contrast, US growth appears to be faltering, home sales are deteriorating, and economists are warning of a possible recession ahead. But consumers are still spending, companies keep making profits and the economy continues to add hundreds of thousands of jobs every month. During it all, prices have accelerated to four-decade highs, and the Fed is desperately trying to quell the inflationary fires with higher interest rates. This makes borrowing more expensive for households and businesses.

The Fed hopes to pull off the triple axis of central banks: slow the economy enough to curb inflation without causing a recession. Many economists doubt the Fed’s ability to manage this feat, the so-called soft landing. A high rate of inflation is often a side effect of an overheating economy, not the current tepid pace of growth. Today’s economic brief conjures up bleak memories of the 1970s, when hyperinflation, in a kind of poisonous brew, coexisted with slow growth. He launched an ugly new term: stagflation.

Although growth appears to be faltering, the job market still looks very strong. Consumers, whose spending accounts for nearly 70% of economic output, are still spending, albeit at a slower pace. The Fed and economic forecasters are stuck in uncharted territory. They have no experience analyzing the economic damage caused by a global pandemic. The results so far have been modest. They failed to anticipate a fiery economic recovery from the 2020 recession – or the massive inflation that unleashed it. Even after inflation accelerated in the spring of last year, Federal Reserve Chairman Jerome Powell and several other forecasters downplayed the price hike as merely a “transitional” result of supply bottlenecks that would soon fade.

Where is the EUR/USD headed after today’s events?

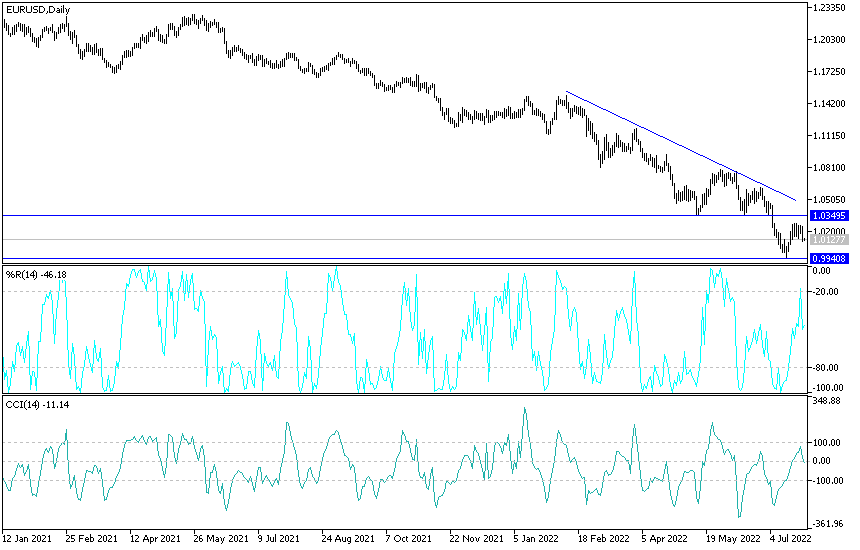

The general trend of the EUR/USD is still bearish. If today’s data is in favor of the strength of the US economy, coinciding with the US Federal Reserve’s new hike in the US interest rate, the EUR/USD may be exposed to new strong selling that may well exceed the parity price barrier. On the other hand, according to the performance on the daily chart, there will be no chance for the bulls to control the EUR/USD pair without moving towards the resistance levels 1.0330 and 1.0550 respectively, otherwise the general trend of the EUR/USD will remain bearish.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]