[ad_1]

ETH/USD has been able to sustain gains that it has produced incrementally, increasing support levels and helping to create a rather speculative technical tide of wagers.

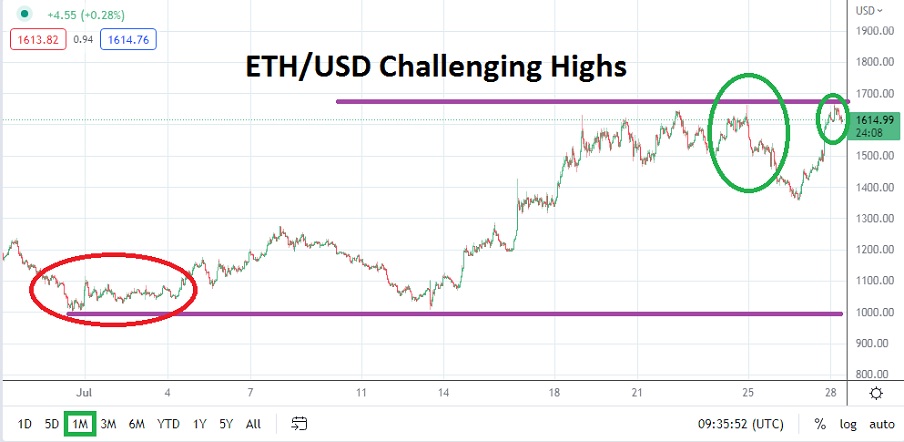

As of this writing ETH/USD is trading above the 1600.00 ratio. On the 1st of July ETH/USD was trading a hair above the 1000.00 level; this represents a 60% gain since the start of the month. As August gets set to start ETH/USD may appear to be traversing within the shadows of its larger counterpart Bitcoin, but its actual gains have been more worthwhile from a percentage viewpoint comparatively. However, volatility remains ever present in Ethereum and the cryptocurrency has not become free of its wagering landscape.

On the 30th of June, ETH/USD was trading near the 988.00 mark and dark skies loomed over the cryptocurrency. Again on the 13th of July, ETH/USD found its value stumbling below 1000.00 again, this after hitting a high of nearly 1277.00 on the 7th of July. However, since reaching the lower depths of its value again on the 13th, ETH/USD has managed to produce a technically positive chart. Well, that is if you throw out the results seen recently on the 26th of July when ETH/USD was trading at 1358.00 after touching a high of nearly 1670.00 on the 24th.

Moves Higher in ETH/USD Shakes Skeptics and Causes Optimistic Speculation

Speculators have seemingly woken up regarding ETH/USD, as it has seen a sustained upwards move the past two weeks. Yes, the drop in value displayed only two days ago underscores a vast sea of volatility awaits all traders. The moves higher have not been a one way avenue and reversals lower can wipe a trader out in the blink of an eye, if too much leverage has been used and stop loss orders have not been implemented.

- Support has proven durable and incrementally climbed the past two weeks in July for ETH/USD, but strong reversals are still being produced.

- Speculators who are optimists and profited may continue to pursue higher ETH/USD targets, but solid risk management is always needed.

Ethereum Gains have been sustained but will they continue to Climb?

The broad cryptocurrency market has begun to show signs of positive movement the past two weeks. However, traders of ETH/USD need to consider if the price action is part of a legitimate move higher and has started to ignite positive behavioral sentiment which will be long lasting?

And traders also need to consider the negative and potential the move upwards is merely sucking speculators into long positions, which are allowing others who have been holding ETH/USD an opportunity to get out of the market alive and without devastating losses. In other words, deciphering the duration of the positive momentum suddenly emerging remains suspect technically, and a large amount of traders may remain cautious about ETH/USD.

ETH/USD Outlook for August

Speculative price range for ETH/USD is 850.00 to 2028.00.

The gains made in ETH/USD during July have been impressive. However, skeptical traders may still be looking at Ethereum and questioning its potential for sustaining momentum higher. The long term bearish trend has not been erased and ETH/USD would have to climb above 1800.00 and then seriously challenge 2000.00 to make some traders forget about the negative results seen the past handful of months.

However, if ETH/USD does start to slide backwards, support levels near the 1400.00 should be watched. If a drop below this level occurs and ETH/USD was to suddenly find its value challenging the 1300.00 and appearing vulnerable, this would not be a good signal and could justify bearish traders aiming for lower values again.

Bullish speculators who have been brave enough to pursue long positions of ETH/USD may be smiling. Gains the past two weeks have proven mostly durable, but reversals continue to be a feature of the ETH/USD. If the 1500.00 level can be maintained and a serious push above 1675.00 is built upon, traders could not be blamed for thinking the 1700.00 to 1800.00 price junctures will be targeted.

If ETH/USD were to actually sustain its push higher and the 1900.00 level is flirted with, some wagers may begin to dream about the 2000.00 level being demonstrated again. Traders need to remain realistic and cashing out profits should they occur remains a wise choice.

Ready to trade our monthly Forex forecast? Here are the best Forex brokers to choose from.

[ad_2]