[ad_1]

The bulls’ control over the performance of the GBP/USD currency pair last week was remarkable, as the currency pair moved towards the 1.2245 resistance before closing the week’s trading stable around the 1.2182 level. The pair’s gains were in the first place amid the halt of the US dollar’s gains following the Federal Reserve’s signals. The act is one of the results of some important US economic data, the most important of which was the announcement of a technical recession for the US economy.

The GBP/USD exchange rate has risen since the middle of the month, but experts at HSBC look forward to this week’s Bank of England (BoE) policy decision and suggest that the bank’s institutional clients are considering selling in anticipation of a reversal in the pound. In general, the US dollar has been sold broadly in the two weeks since the middle of the month and in favor of many currencies including the British pound, but HSBC Research doubts that the rise in the GBP/USD pair can continue until the interest rate decision on Thursday.

Dominic Boning, head of European forex research at HSBC, wrote in a note to clients: “Even if the Bank of England offers a 50 basis point rise, it may do so with some cautious elements. These may come in the form of weaker growth expectations in the August inflation report, which is likely to increase market doubts about the potential range and continued interest rate hikes going forward.”

What will the Bank of England do next?

Overall, overnight index swaps prices indicated that the bank interest rate is likely to rise to 1.64% next Thursday, which is more than the 1.5% that would prevail if the Bank of England raised the benchmark by 25 basis points but less than the 1.75% that would remain. If the Bank of England moves 50 basis points larger. This amounts to something like an implied 68% probability of a larger-than-normal 0.50% increase and that in itself suggests that Sterling could face a setback if the BoE sticks to the steady pace of 0.25% increases thus far, which is one of the drivers behind the idea of HSBC trading.

“We believe that the balance of risks to sterling remains to the downside around the August meeting,” Banning added. The HSBC team has called on clients to sell sterling and look for a downside move to 1.1890 in the coming weeks, but they also suggested they stay out of trading if the market rises to 1.2260 instead.

Bank of England Governor Andrew Bailey said at the Official Financial and Monetary Institutions Forum (OMFIF) even earlier this month: “We wanted people to understand that, therefore, there are more options on the table than just 25 basis points and it could go These options go both ways.” For its part, the Bank of England warned that it could act “more aggressively” again in June, and policymakers including Governor Andrew Bailey and chief economist Howe Bell have since suggested that the bank rate could rise faster and more than previously forecast.

However, there is still debate as to whether the economic conditions needed to change this move have been met in the meantime.

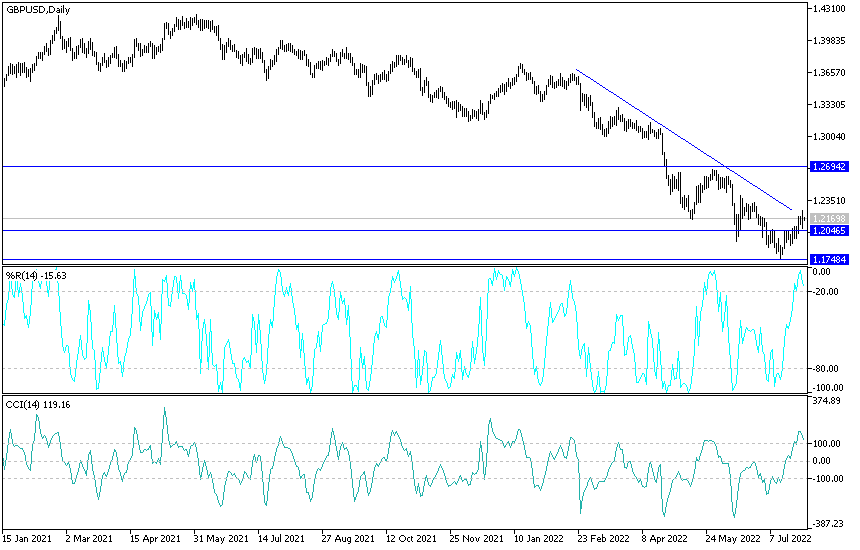

Technical forecast for the GBP/USD pair:

In the near term and according to the hourly chart, it appears that the GBP/USD is trading within an ascending channel. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to ride the current trend towards 1.2202 or higher to 1.2246. On the other hand, the bears will target short-term pullbacks at around 1.2115 or lower at 1.2067.

In the near term and according to the performance on the daily chart, it appears that the GBP/USD currency pair has recently completed an upward breach of the descending channel formation. This indicates bulls trying to control the pair. Therefore, the bulls are looking to extend the current rebound towards 1.2360 or above to 1.2587. On the other hand, the bears will target long-term profits at around 1.2007 or lower at 1.1766.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]