[ad_1]

Sterling started August trading with solid gains against both the euro and the dollar, but the risks fall later this week if the Bank of England holds back a 25 basis point rate hike on Thursday. The GBP/USD pair succeeded in rebounding higher with gains to the 1.2293 level, then returned amid selling operations to stabilize around the 1.2135 support level at the time of writing the analysis.

Financial market pricing shows that investors are in full position for a 50 basis point hike from the British central bank’s Monetary Policy Committee as it works to strengthen its response to rising UK inflation and inflation expectations among consumers and businesses.

But some prominent economists warn that a 50 basis point hike is not yet reached, and there are reasons to expect the central bank to maintain its preference for moving in 25 basis point increments, indicating downside risks for the pound. “YouGov’s measure of household expectations for 5-to-10-year inflation fell again in July, to 3.8%, from 4.0% in June,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. Next year’s forecast also fell to 6.0%, from 6.1%. And the balance of data developments since then the MPC meeting in June suggests a probability increase of 25 basis points over 50 basis points.”

The analyst is always one of the most accurate economic forecasters in the UK according to Bloomberg and Reuters quarterly surveys.

The same survey cited by Tombs showed that 12-month inflation expectations fell to 6.0% from 6.1%. The Bank of England is particularly sensitive to inflation expectations as it can be affected by changes in interest rates. And while inflation expectations as measured by Citi and YouGov appear to have peaked, they are still well above the Bank of England’s 2.0% target, meaning most economists do not expect the data to affect the bank’s approach.

That alone will keep the odds up 50 basis points.

With the market investing heavily in the 50bp bet, sterling could be at risk of pulling back if the bank disappoints against this forecast on Thursday. More risks come in the form of a 50 basis point rise, but the bank is signaling a pessimistic outlook, lowering medium-term growth and inflation expectations, signaling a slowdown in the rate-raising cycle. This is exactly what the Reserve Bank of Australia did on Tuesday, sending the Australian dollar down sharply following the decision.

Adam Cole, chief currency strategist at RBC this week sold the GBP/CHF this week as he expects the Swiss Franc to outperform and the Bank of England not to support. The exchange rate of the British pound to the euro rose 2.5% during the month of July, supported in part by expectations that the Bank of England will be more active. The pair is back above 1.1950 at the time of writing with bank accounts offering rates at around 1.1710 for Euro payments and forex specialists providing rates around 1.1910.

For his part, says Viraj Patel, analyst at Vanda Research, the reasons for the bank’s commitment to a 25 basis point hike this week outweigh any need to increase the tempo with a 50 basis point increase. Currency analysts at Citi have a negative view of the British economy and the British Pound as the BoE event approaches this week. Citi highlights the risks of raising key interest rates into an economic slowdown on the back of multi-decade inflation.

Analysts say a larger fiscal support package from the new prime minister will ease a hard landing for the British economy, but this is at a time when borrowing costs are rising.

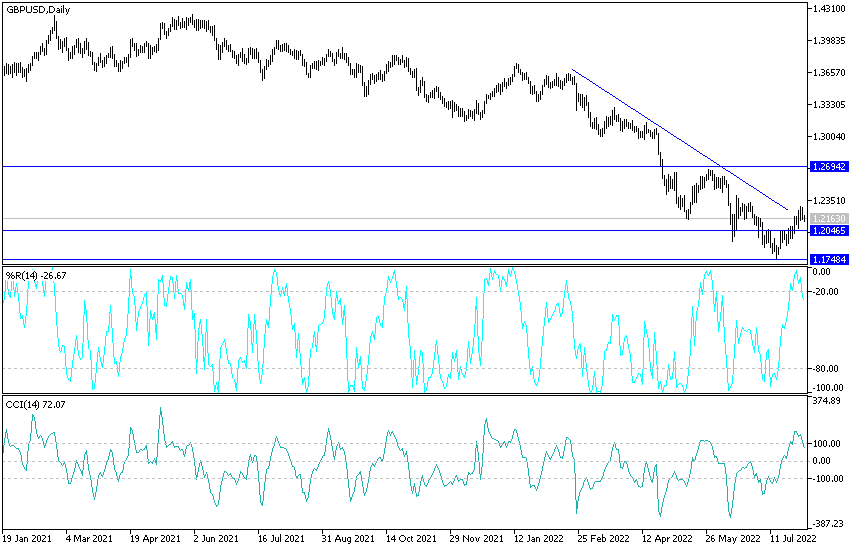

Technical forecast for the GBP/USD pair:

I still see that GBP/USD gains will be subject to selling at any time as the strength of the US dollar continues to expand. With a stronger future of monetary policy tightening by the Federal Reserve, the US dollar is a safe haven currency and global geopolitical tensions are on the rise at present. Bears moving towards the 1.2100 and 1.2020 support levels will end the bullish expectations and start the bears moving strongly to the downside.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]