[ad_1]

Despite the recovery of the US dollar during the recent trading sessions, the XAU/USD gold price is trying to hold its ground this week. The price of gold jumped towards the resistance level of 1788 dollars an ounce and was subjected to limited selling towards the level of 1754 dollars an ounce. It settled around the level of 1765 dollars an ounce in the beginning of trading today, Thursday . The US dollar reversed its earlier losses to post daily gains against some of the other major currencies after the Institute for Supply Management (ISM) Services Purchasing Managers’ Index (ISM) confounded market expectations with a July rally in contrast to the alternative measure compiled by S&P Global.

Yesterday’s ISM Services Index surprised the currency and bond markets when it rose from 55.3 to 56.7 last month after rising due to sharp increases in new orders and general business activity within the largest and most important sector of the US economy. Supplier deliveries also accelerated while the price sub-component of the gauge fell 7.8% in its third consecutive monthly decline, also its largest decline since 2017, indicating that inflation pressures may be moderating.

About 13 out of 16 subsectors in the overall service industry reported a slight increase in business activity for the month of July, leading to an increase in the overall ISM services PMI in contrast to the S&P Global survey, which previously indicated that the sector contracted sharply last month.

The decline reported by S&P Global pushed the services sector PMI to its lowest level since June 2020.

The survey comes just days after the Bureau of Economic Analysis said US economic output fell -0.9% during the second quarter, making it the second straight quarterly decline that has many in the market asking aloud whether the US is on the cusp of a recession.

For its part, the Federal Reserve last week cited evidence of further economic slowdown in the second quarter as one of the reasons it has been more attentive to US economic numbers over the eight weeks leading up to its next monetary policy decision in September. Chairman Jerome Powell said last Wednesday that the Fed will take into account a range of US economic indicators when deciding in September whether to cut the size of US interest rate increases, sending the dollar broadly lower.

While the Fed acknowledged signs of slowing last week, many Fed officials were also quick to express skepticism about the idea that the economy is on the cusp of a recession and Wednesday’s data is one indication that they may be right to be conservative. This is to the extent that the message of the ISM survey is replicated by other data in the coming weeks, it could lead the Fed to feel more comfortable continuing to raise interest rates in big increases over the coming months, especially if inflation shows no signs of doing so.

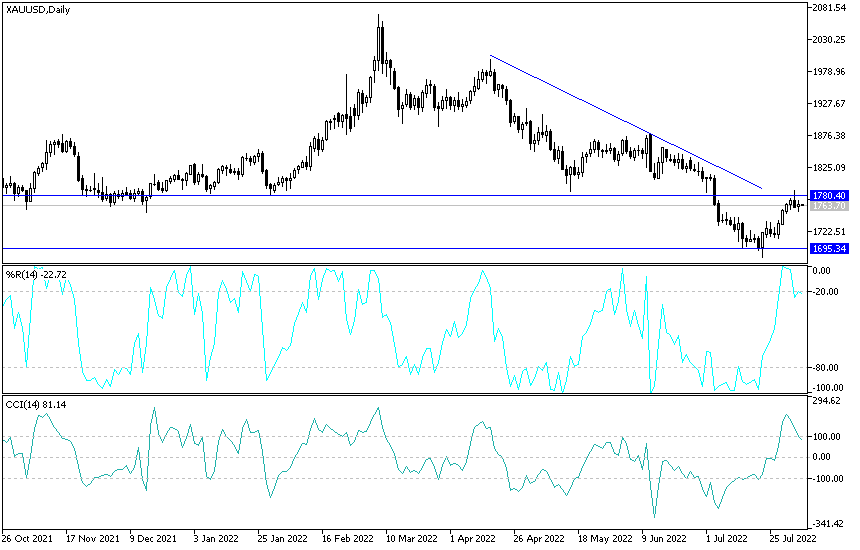

Today’s XAU/USD Gold Price Forecast:

Despite the recent strength of the US dollar, the XAU/USD gold price showed resilience as this recovery was offset by increased global geopolitical tensions, which is a fertile environment for gold gains. The bulls are determined so far to move towards the psychological resistance level of 1800 dollars per ounce, which is the most important level for the outlook of the general upward trend. On the other hand, according to the performance over the same time period, the movement of the gold price towards the support levels of 1748 and 1730 dollars will be important for the bears in controlling the direction of gold. I still prefer buying gold from every bearish level.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.

[ad_2]