[ad_1]

Today’s recommendation on the lira against the dollar

Risk 0.50%.

The buy deal of Thursday was activated and the exit was made after making a profit with closing half of the contracts and moving the stop-loss point as the price progressed towards the target.

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

- Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

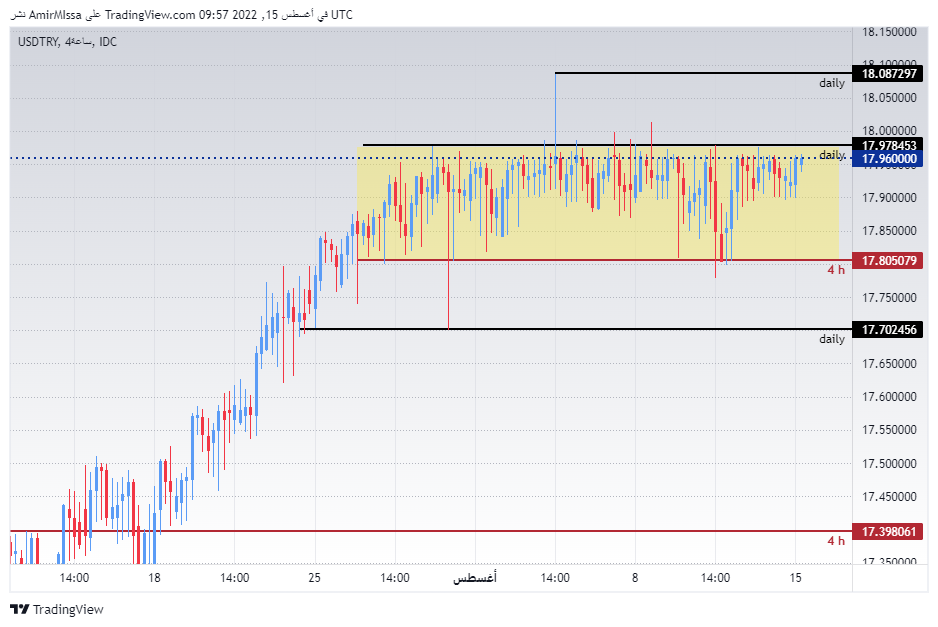

The price of the Turkish lira against the US dollar has stabilized unchanged at the same level for nearly three weeks, which clearly shows the intervention of the Turkish Central Bank in the exchange markets to achieve a kind of balance for the price of the USD/TRY currency pair. Indirectly, the Turkish Central Bank began preparing the atmosphere for a further decline of the lira against the dollar, after a poll published at the end of last week, which included the opinions of some representatives of the financial sector in the country, which showed a downward trend in the lira price. Expectations focus on the dollar reaching levels of 19 pounds by the end of this year. The poll also included pessimistic expectations regarding inflation levels in the country. In general, the economic data shows that there is no significant improvement in the upcoming expectations, which may be reflected in the price of the lira, which has no choice but to decline.

Technical Analysis

On the technical front, the US dollar against the Turkish lira settled without changes, as the pair settled within the same narrow trading range shown on the chart. It is an image that reflects the extent of the Turkish Central Bank’s control over setting a ceiling on the price of the lira. The pair maintained trading between the support levels that are concentrated at 17.85 and 17.75, respectively. While the lira is trading below the resistance levels at 18.00 and 18.07, respectively. The pair is also trading above the 50, 100 and 200 moving averages, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]