[ad_1]

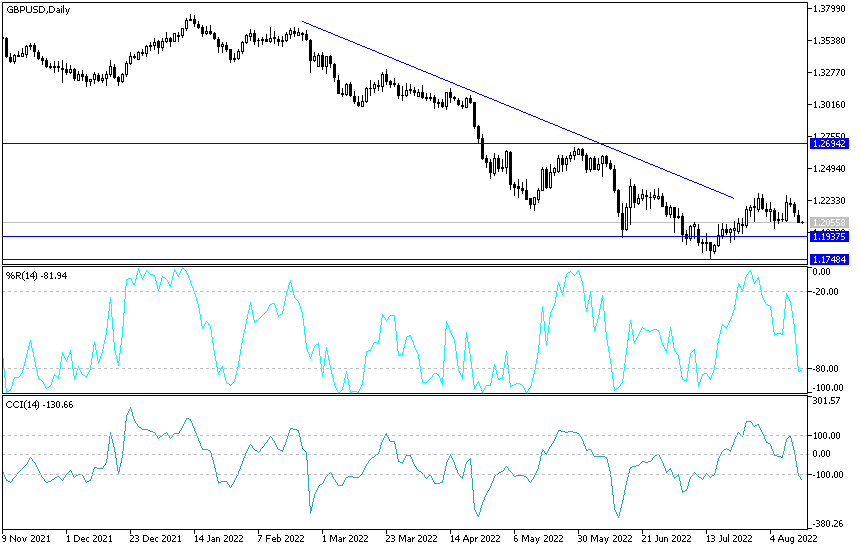

The GBP/USD exchange rate attempted to extend its month-long recovery last week, but was unable to reach a new high. It could now head into a period of neutrality with a bearish bias unless the action-packed economic calendar provides catalyst for new progress. The GBP/USD pair fell to the 1.2050 support level at the beginning of this week’s trading, and the rebound gains last week brought it to the 1.2277 resistance level.

There were multiple signs last week that a significant moderation in US inflation was approaching, albeit not enough to dissuade the Federal Reserve (Fed) from its hawkish policy stance, leading to continued interest rate risks that also limit the factors for the sterling. “The weak inflation reports have caused some understandable relief to risky assets and downward pressure on the dollar,” Michael Cahill, FX analyst at Goldman Sachs, wrote in a research briefing on Friday. “That is likely to extend a bit given the light calendar going forward and the possibility that this week’s FOMC meeting minutes will include some discussion about the FOMC’s apparent desire to slow the pace of advances soon.” But we don’t expect that to be a lasting relief.”

Data last week indicated that every official measure of US inflation was either slowing or declining in July, while separate measures of producer prices and import costs also surprised to see declines in the recent period.

Meanwhile, a New York Fed survey showed expectations of future inflation falling on all horizons last month, and a significant University of Michigan survey indicated that expectations fell on all but the longer horizons.

The problem for sterling and the dollar lies in things like staffing costs per capita, which rose 10.8% annually in the second quarter after a 12.6% increase previously and in a result that wage growth rates have slowed to a decline from their highest levels in recent decades. Taken together with the rise in long-term expectations combined with the recent reduction in market expectations for the Fed funds rate, these factors keep US inflation and interest rate risks to the upside while limiting the pound-dollar rate in its ability to recover.

“Wednesday’s retail sales report is the most popular data in this week’s calendar,” says Kevin Cummins, chief US economist at Natwest Markets. Thursday’s weekly jobless claims also require more attention, in light of the recent improvement. “We expect the minutes to confirm the additional price hike to a restrictive position that remains in place for this year,” he added. Accordingly, “we doubt that the FOMC will send any clear message whether the expectations for a rate hike in September are 50 basis points or 75 basis points.”

What’s next for GBP/USD?

A lot about how the GBP/USD price will move in the coming days is likely to be determined by a busy economic calendar that includes several very important dates for both the Pound and the Dollar. Accordingly, Juan Manuel Herrera, an expert at Scotiabank, says: “The energy crisis and the cost of living crisis indicate that there are economic headwinds awaiting the British economy, and this will limit the ability of the pound to advance.”

“The top of the range this week coincided with a test of the major resistance at 1.2275 and failure here indicates the risks of the cable returning to the 1.20 region. We notice a major support at 1.2080 in the short term.”

The UK economic outlook remains weak. The Bank of England still expects a recession to start in the fourth quarter of 2022, although the risk is closer. Employment figures will be closely scrutinized on Tuesday for clues about labor market resilience and for insight into the trend in wage growth, both of which are influential when it comes to the matter is the outlook for the Bank of England (BoE) interest rate policy. Wednesday’s UK inflation numbers are the most important for the BOE and GBP monetary policy in the short term, and this time there is uncertainty about how the market is likely to respond to upside or downside surprises.

Sterling dollar forecast:

- The GBP/USD currency pair is closest to testing the psychological support 1.2000.

- It may increase the bears’ control over the trend.

- It will prepare to test stronger support levels, the closest to them are currently 1.1975 and 1.1880, respectively.

On the other hand, and over the same time period, moving towards the resistance levels 1.2145 and 1.2300 will be important for the bulls, and in general, I still prefer to sell the GBP/USD from every bullish level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]