[ad_1]

For four trading sessions in a row, the price of the USD/JPY currency pair is settling in a narrow range between the support level of 131.73 and the resistance level of 133.90. It settled around the level of 133.11 at the time of writing the analysis. The currency pair may remain moving in a narrow range until the release of the minutes of the last meeting of the US Federal Reserve this week. The importance of the minutes is due to the fact that the markets and investors derive from it the date and amount of raising US interest rates in the coming months.

Dollar-Yen Economic Outlook

A measure of manufacturing health in the United States recorded its second largest decline ever, in a sign of the continued slowdown in American activity. However, the scale of the collapse has led some economists to question the outcome. The New York Empire State Headline Index for August read -31.30. The market was looking for a slowdown from 11.10 to 5.50 June.

The market slump is the second largest drop in the survey going back to 2001.

The US has recorded two consecutive quarters of growth, thus meeting the common definition of recession. The National Bureau of Economic Research which tells the US government’s reading of the state of the economy says those benchmarks are too simplistic and should still call a recession.

Pantheon Macroeconomics says the result means other regional surveys will be watched with increased interest in the wake of the New York shock. The survey also offered some optimism, particularly regarding inflation. The price-paid component fell by 8.8 points, thanks in large part to lower oil prices.

Inflation expectations are very important to the outlook for the US economy, Fed policy and the outlook for the US dollar. Indeed, there were hopes that the US economy had experienced peak inflation with the July key rate rising 8.5% in the year to July, dropping to less than 9.1% in June and consensus forecast for a reading of 8.7%. Core US CPI rose 5.9% in the year to July, unchanged in June, but less than the 6.1% consensus was looking for. The US dollar fell as investors bet that peak inflation might be over, thus reducing the need for the Federal Reserve to pursue a strict policy of raising interest rates.

In the event that peak inflation is indeed surpassed, the assumption that the Fed will slow will persist, making it difficult for the dollar to push towards new highs.

Dollar against Japanese Yen Forecast

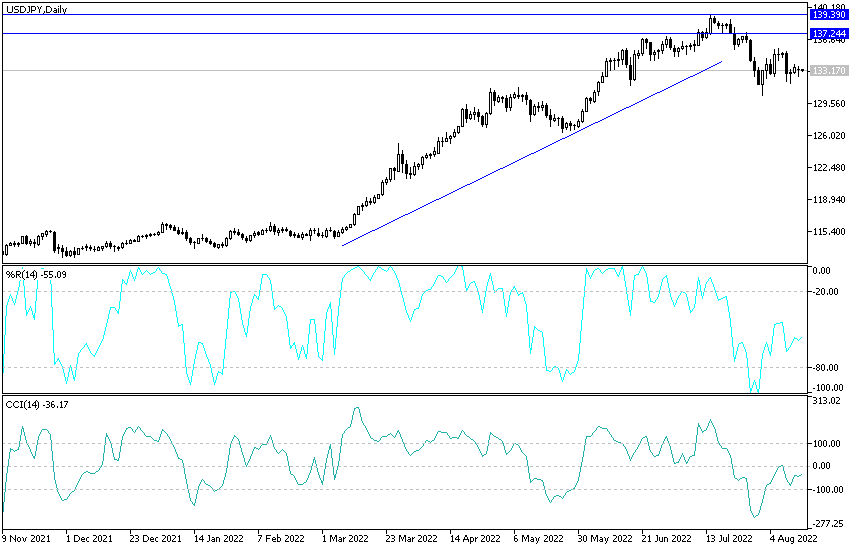

There is no change in my technical view for the performance of the USD/JPY currency pair on the daily chart.

- The currency pair is in a relatively neutral performance, and the bias will be bullish if it returns to move towards the resistance levels 134.20 and 135.00, respectively.

- The dollar-yen pair’s move towards the support level 131.55 will have a strong impetus to retreat to the vicinity of the psychological support 130.00.

- The currency pair will be affected today by the announcement of housing and industrial production data in the United States.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]