[ad_1]

We will see a lot of choppy and sideways behavior, meaning that you should probably be looking more or less at a range-bound type of trade.

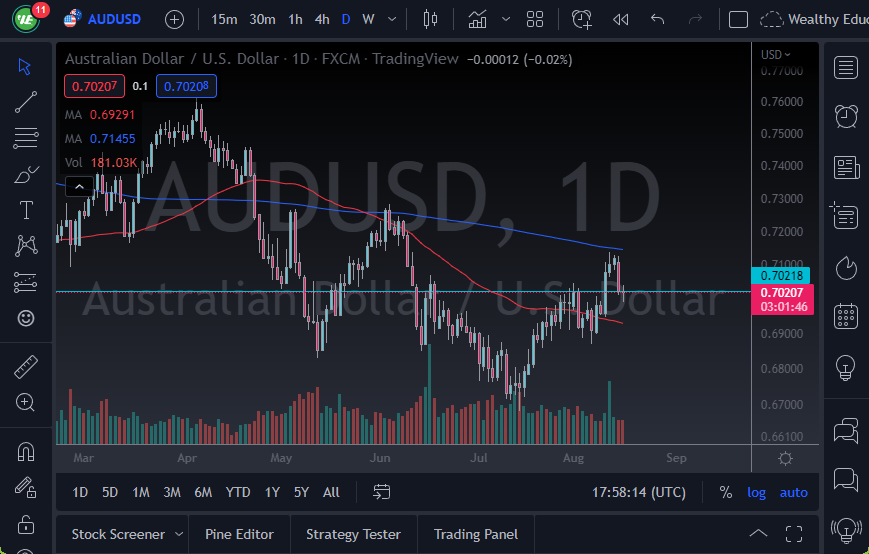

- The AUD/USD currency pair pulled back a bit Tuesday to test the 0.70 level.

- It should be noted that the 0.70 level has been important multiple times in the past, so it does make quite a bit of sense that the market would stall here.

- The question now is where we go from here, as this was the scene of a rather significant breakout.

The 0.70 level of course has a lot of psychology attached to it, so in and of itself is reason enough to think there might be some trouble. If we break down below the bottom of the candlestick for the trading session on Tuesday, then it’s likely that we go lower, perhaps reaching the 50-Day EMA. The 50-Day EMA is closer to the 0.6925 level, and of course, we have seen support at the 0.69 level previously. In other words, there is a lot of noise underneath that could come into the picture and keep the market somewhat elevated.

Tied to the US Dollar

At this point, it’s probably worth noting that the Australian dollar has fared better against the US dollar than many other currencies, so if we are going to see the US dollar selloff, it’s likely that we will see it get turned around here first. The market breaking above the 200 Day EMA above would be a very bullish sign, perhaps kicking off a new bullish trend.

We will have to be very cautious about that though because the Australian dollar is highly levered to China, which seems to have a lot of its own problems right now. Furthermore, we also have to worry about risk appetite in general, because the US dollar could pick up a bit of a bid if people start freaking out. I think more than anything else, we will see a lot of choppy and sideways behavior, meaning that you should probably be looking more or less at a range-bound type of trade. In the next 24 hours, it does look like we are going to deal with a little bit of support that could cause his market to bounce, albeit ever so slightly. This is a market that continues to see a lot of crosscurrents, but you can probably say that about almost every currency pair at the moment. Pay attention to the 10-year yield in America, because if it starts to rise again, that could send the Aussie lower.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]