[ad_1]

If we break down below the ¥101 level, that could be a major turnaround just waiting to happen.

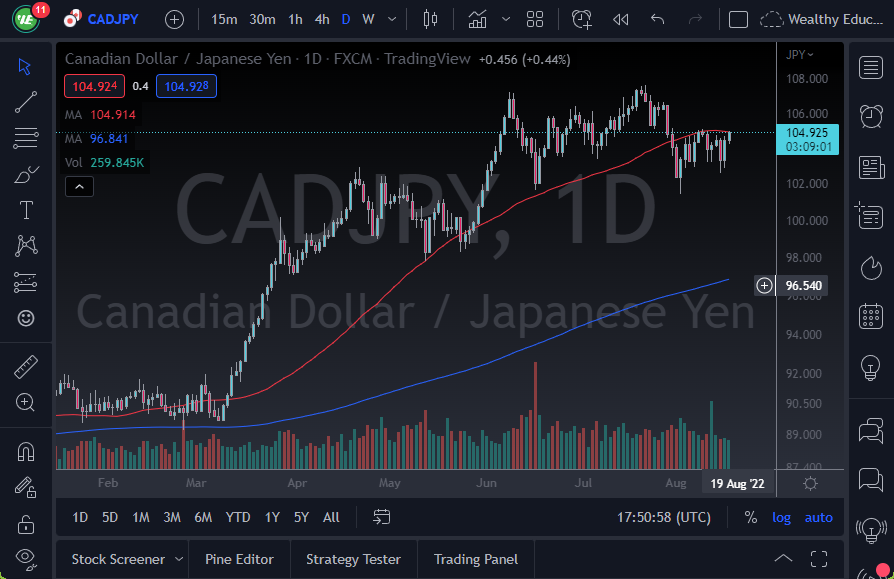

The Canadian dollar has rallied a bit during the trading session on Wednesday to show signs of life again, as we are now threatening the ¥105 level. Furthermore, the 50-Day EMA is sitting right around the same level as well, so I think it’s probably only a matter of time before we see a bit of a fight on our hands.

Factors to Keep in Mind

- The oil markets because we do see some type of recovery in the oil markets, which obviously helps the Canadian dollar.

- Most of the effort in this market will probably come from the Japanese side of the equation.

- The Bank of Japan continues to fight to keep the 10-year yield in that country down to 0.25%, which is a Herculean effort, to say the least as interest rates around the world have been rising.

In fact, Japan has seen inflation for most of this year, which is the first time in years. Because of this, the Bank of Japan has to step in and continue to buy “unlimited bonds” in order to keep the bench right where it wanted. That’s tantamount to printing “unlimited yen”, which obviously increases the supply of that currency in the markets. If the interest rates around the world continue to rise, the Japanese yen will continue to take it on the chain, which is what we have seen everywhere, not just against the Canadian dollar.

Ultimately, we are in an uptrend, and now the question is whether or not we can break significantly above the ¥105 level. If we cannot, it’s more likely than not that we are going to see a sideways type of market, with the ¥102 level underneath offering support, as we banged around and tried to work off some of the froth. If we break down below the ¥101 level, that could be a major turnaround just waiting to happen. A lot of this is going to come down to the overall yields in bonds, not just these 2 countries. Because of that, you need to keep a broad-based perspective on yields.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]