[ad_1]

I have no interest in buying the Euro until we clear the 1.06 level to the upside.

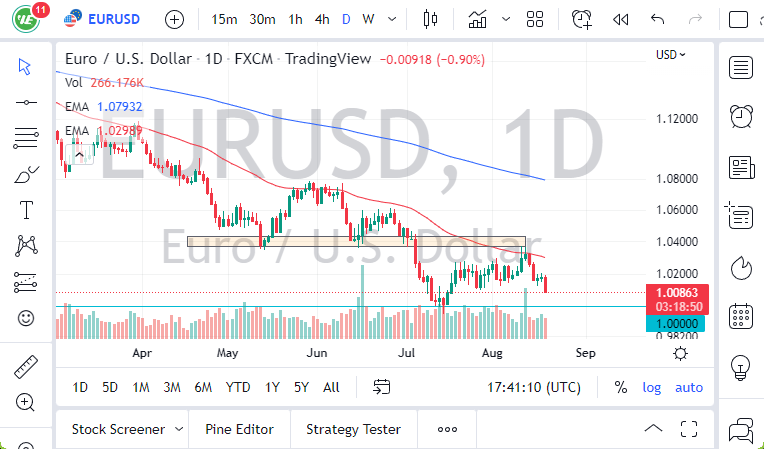

The EUR/USD currency pair continues to take a bit of a beating as we have seen it drop through the 1.01 level during trading on Thursday. There is probably not much that’s going to keep it from going to the parity level over the next couple of days, which of course is an area that will attract a lot of attention. At this point, I think it’s almost a foregone conclusion.

The Euro has a whole host of problems that it has to worry about, that the United States simply doesn’t need to concern itself with. The lack of energy in the European Union this year is going to be a major issue, and even though Germany has been building up gas supplies, it is still far from being out of the woods.

Market participants also will be paying attention to interest-rate expectations, and even though there is a delusion amongst traders that the Federal Reserve can ignore inflation and start easing again, the reality is that the ECB is even further away from being able to pretend that it can fight inflation. Quite frankly, the European Union is stuck between a rock and a hard place, and the currency markets are very well aware of this. As long as that’s going to be the case, it’s difficult to make a case for the Euro to rise over the longer term.

EUR/USD Price Predictions

Breaking below the parity level opens up the possibility of a move down to the 0.98 level, something that I don’t necessarily think will be easy to make happen, but it is possible. Generally speaking, I think that rallies will be sold into at the first signs of exhaustion, as we obviously have a lot of negativity out there and it does not seem to be going anywhere.

- The size of the candlestick is somewhat important, as it does suggest that perhaps we have plenty of downward momentum. Whether or not that carries through into the weekend is a completely different question altogether, but it does make quite a bit more sense that traders might be willing to hold US dollars over the weekend instead of Euros.

- Once we get a daily close below the parity level, I anticipate that there will be even more varied pressure in this market.

- I have no interest in buying the Euro until we clear the 1.06 level to the upside.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]