[ad_1]

The Dow Jones Industrial Average saw its biggest one-day, pips, and percentage loss since June 16th.

The Dow Jones Industrial Average closed sharply lower during its recent trading at the intraday levels, to record losses for the second consecutive session, by -1.91%. The index lost about -643.13 points and settled at the end of trading at the level of 33,063.62, after its decline in trading last Friday by -0.86%. It ended the week’s trading with a decrease of -0.16%.

The Dow Jones Industrial Average saw its biggest one-day, pips, and percentage loss since June 16th, as investors remained concerned about the possibility of another aggressive rate hike.

Federal Reserve Chairman Jerome Powell and other central bank officials and policymakers will gather this week at the annual Jackson Hole event. Powell is due to deliver a speech on the economic outlook on Friday, and investors will hear any indication of whether a 50 basis point or 75 basis point increase is likely at the September FOMC meeting.

The probability of the Fed raising rates by 75 basis points to a range of 3% to 3.25% increased to nearly 54% as of Monday, compared to 47% on Friday and 39% a week ago.

Investors will also be looking for details about the Fed’s plans to cut its roughly $9 trillion balance sheet, a process that began in June.

Dow Jones Technical Outlook

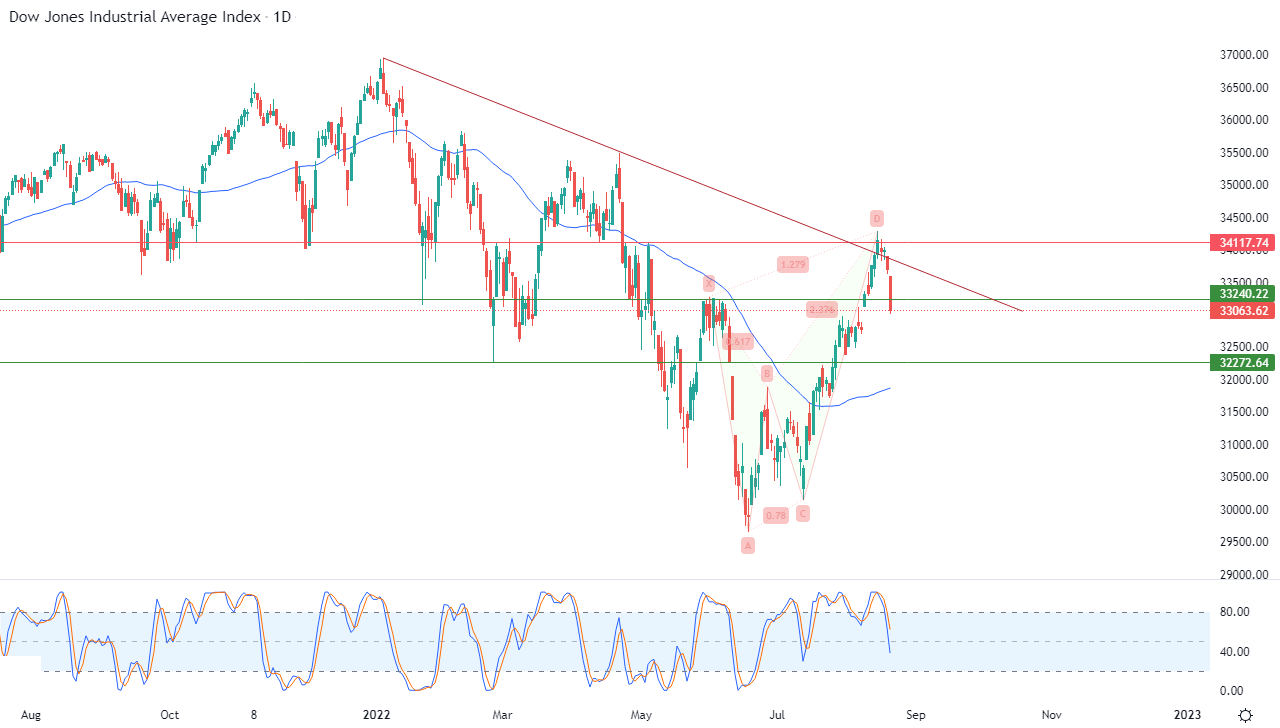

- Technically, the index previously faced a strong resistance represented by a bearish trend line in the medium term.

- This is shown in the attached chart for a (daily) period.

- This coincided with the start of negative signals on the relative strength indicators, after they reached at the same time overbought areas.

- It caused increasing pressure on the index to break in its recent trading the 33,240 support level.

All of this comes in light of the dominance of a bullish corrective wave in the short term, supported by its continuous trading above its simple moving average for the previous 50 days. It represents the last stronghold of support that could gain it the necessary positive momentum and give it the ability to regain its recovery.

Therefore, given the index’s stability below 33,240, we expect it to decline further during its upcoming trading, to target the support level 32,273.

Ready to trade the Dow Jones in Forex? Here’s a list of some of the best CFD brokers to check out.

[ad_2]