[ad_1]

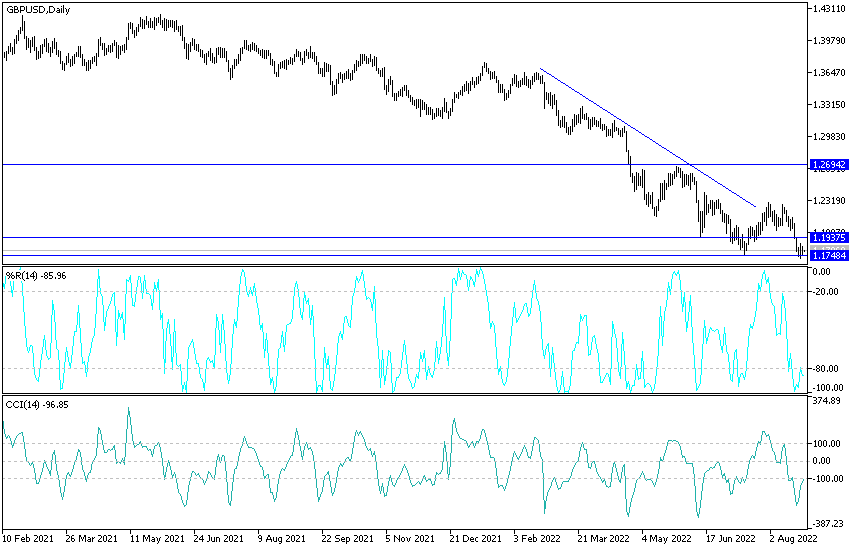

Since trading began this week,the price of the GBP/USD currency pair has settled around its losses towards the 1.1717 support level, its lowest since the peak of the collapse of the markets due to the Corona pandemic in 2020. The GBP/USD pair is stable around the 1.1795 level at the time of writing this analysis, waiting for anything new. The US dollar is still the strongest in the markets given the expectations for an interest rate hike and the sterling is waiting for a sharp recession and a new British prime minister.

About the performance of the GBP/USD, Mark Cogliati, Director of Global Capital Markets at Validus Risk Management, investigates the catalysts that could ultimately end the pair’s decline. Since the start of 2022, the pound has fallen 11.8% against the dollar, making it one of the worst performing currencies (in terms of spot yield) in the G10.

Only the Norwegian krone (-13.45%), the Swedish krone (-13.89%) and the Japanese yen (-15.74%) were worse off. With GBP/USD testing below $1.18 and seemingly only going in one direction, we once again find ourselves wondering how far will the pound fall and what will be the impetus to change it?

When I wrote an article on this topic last month, I pointed to the depreciation of the pound as a key factor that might prevent it from falling much further. Over the past fifteen years, the GBP/USD has not exceeded +/- 20% deviation from the “fair value”. This is still true today, with the pound currently undervalued by 19.3% (we calculate fair value using a mixed CPI/PPI model). However, those of us who can remember the days of GBP/USD will note that the British pound was overvalued for a few years before falling sharply in 2008 at the height of the global financial crisis.

With this in mind, it is not out of the realm of possibility that the pound will fall further and remain undervalued for a long time. As for the future, the narrative seems very bleak. The sterling reacted in particular to last week’s reading of higher-than-expected inflation for July (the headline CPI rose 10.1% y-o-y vs. consensus expectations at +9.8%) and Friday’s stronger-than-expected retail sales (+0.3% month-on-month vs. in the previous month’s expectations by -0.2%). With the market quickly turning to price with the prospect of further tightening from the Monetary Policy Committee, the pound sterling fell. Conventional wisdom suggests that the increased likelihood of higher rates should lead to a stronger currency, so the fact that the opposite range is true is a worrying sign for the pound.

The price collapse / currency performance in the UK is closer to what we might expect to see in emerging markets. The problem is that even with nominal rates rising, significantly higher inflation means real rates are still trending downward. An article published by Citi Bank has been picked up by the UK’s mainstream media, suggesting that UK inflation may rise above 18% amid the energy crisis (gas prices in particular).

This is an extreme forecast ,higher than the consensus (11.9%) and the Bank of England’s own forecast (13%) but at the very least, it is a scenario worth considering from a risk management perspective. It may not be out of the realm of possibility if a new prime minister takes over and ignites new financial incentives. Interestingly, looking at Bloomberg’s most recent foreign exchange forecasts, among the banks that updated their forecasts last week, the consensus for the end of the third and fourth quarters was still $1.19.

JP Morgan was a standout, seeing sterling fall to $1.14 at the end of the third quarter before recovering very slowly in 2023. What’s also interesting is that this move is not isolated to sterling. All G10 currencies have fallen against the dollar since the beginning of the year, with the euro performing very similarly to the pound. For the most part, EUR/GBP has largely traded between 0.83 and 0.86 since the start of the year (currently mid-range at 0.8450).

Expectations of the GBP/USD:

- The stability of the GBP/USD below the psychological support level of 1.2000 supports the bears’ control over the trend and warns of a stronger downward movement.

- Despite the technical indicators reaching sell saturation levels after the recent losses, the currency pair did not receive enough momentum to take advantage of this and think about buying, and it may remain so until the reaction from the Jackson Hole seminar organized by the Federal Reserve Bank, which makes Friday’s session the most important and active for the markets and the currency pair.

- Currently the closest support levels are 1.1730, 1.1655 and 1.1580 respectively.

On the upside, the stability above the 1.20 level may have a chance for the first break, and until now there will still be a gain or a rebound, an opportunity to renew the sale of the currency pair.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]