[ad_1]

Today there will be an important event to future recession watchers in light of the continued sharp tightening of the Fed’s policy. The US economic growth rate will be announced amid expectations of a slowdown. The USD/JPY currency pair is stable around the bullish rebound gains of 137.70, which increases expectations towards the psychological top of 140.00. The dollar/yen pair is stable around the 137.10 level at the time of writing the analysis.

Hawkish or Dovish?

Markets and investors will remain focused on Friday, when Federal Reserve Chairman Jerome Powell addresses an annual economic conference in Jackson Hole, Wyoming. This has been the place for market action rhetoric in the past, leading investors to hope that Powell will provide more clarity on a rate hike. Will it be hawkish, which is what investors call the bias towards aggressive rate increases? Or dovish, which is Wall Street’s talk of easier circumstances?

Analysts pointed to several variables that could change the Fed’s thinking ahead of its next rate policy meeting in September. They don’t think he wants to appear tough or pessimistic, maybe he wants to appear as a pigeon. They cautioned that the speech could be “nothing” with little to chew on, although the market may consider that positive given some expectations that Powell will appear hawkish.

Generally high interest rates slow down the economy in the hope of reducing inflation. But they also risk strangling the economy if they are aggressively made and drive down the prices of all kinds of investments.

Stock traders sitting still for now

Stock traders remained reluctant to make any huge bets ahead of Jerome Powell’s speech on Friday, which may provide clues to how optimistic the Federal Reserve is in the face of mounting economic challenges. These concerns did not actually go anywhere despite the controversial pivotal pacifist narrative which some have cited as one of the reasons for the short covering rebound from June lows.

Indeed, before the prestigious Jackson Hole event that Powell and global policy makers will attend, traders have had to absorb more hawkish talk. Minneapolis Fed President Neil Kashkari said late Tuesday that it was “very clear” that officials need to tighten up and get inflation under control again.

Economic reports were mixed at best, underscoring the delicate task that policy makers face in bringing down high inflation without triggering a recession. Wednesday’s data showed US pending home sales fell to the lowest level since the pandemic began. While orders from US factories for core capital goods have exceeded expectations, the picture may change in the coming months amid rising borrowing costs and uncertainty over the growth outlook.

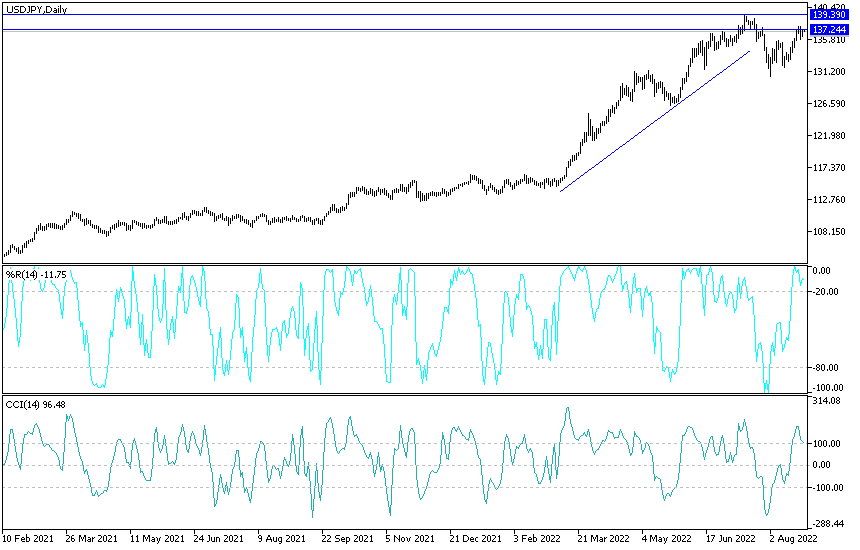

Forecast of the dollar against the Japanese yen

- There is no change in my technical view of the performance of the USD/JPY currency pair, as the general trend is still bullish.

- I expect stability around its gains until the reaction from Jerome Powell’s statements during the Jackson Hole symposium to determine the future of raising US interest, the strength factor of the US dollar in the markets recently.

- The bulls’ destinations closest to the current performance are the resistance levels 137.85, 139.20 and 140.00, respectively.

On the downside, the support level 133.30 will be important to change the trend outlook. The currency pair will be affected today by the risk appetite of investors, as well as the reaction from the announcement of the US GDP growth rate and the number of weekly jobless claims.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]