[ad_1]

The GBP/USD has fallen a bit during the trading session on Wednesday as we continue to see the US dollar strengthen against almost everything. As we are in the midst of the Jackson Hole Symposium, traders are out there waiting to see what Jerome Powell has to say on Friday morning, as the stock markets have been arguing with the central bank as to whether or not they are going to be able to stay tight.

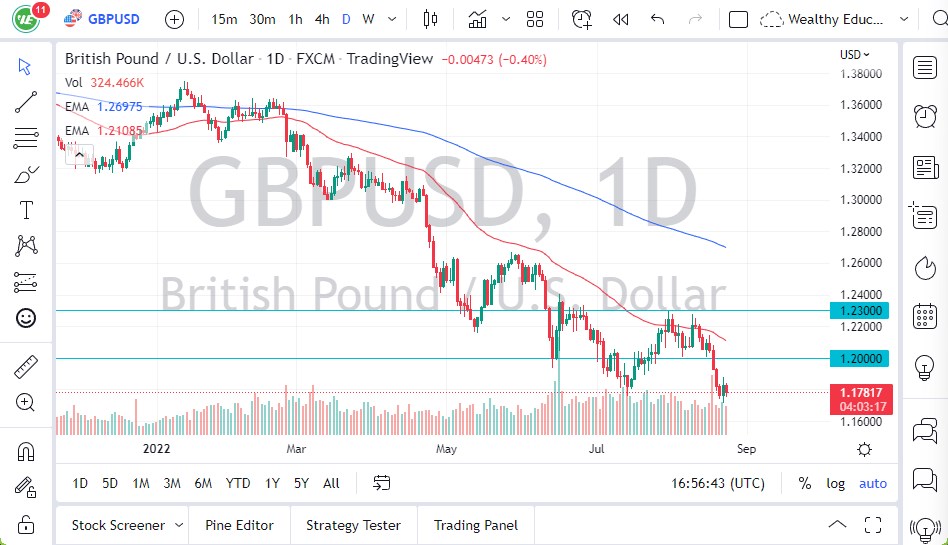

The Bank of England has tightened interest rates recently, but they have also acknowledged that the United Kingdom is going to end up in a recession rather quickly, so therefore I think it makes quite a bit of sense that the British pound continues to suffer. With that being the case, it’s likely that we continue to see a “fade the rally” type of situation, and therefore I am looking for rallies to show signs of exhaustion that I can start selling again. Now that we are threatening to make a fresh, new low, then it’s likely that we could go looking to the 1.15 level which is my target at the moment.

Interest Rates Favors the US Dollar

- The 1.20 level above should be resistance, just as the 50 Day EMA above there should be.

- We have been in a very strong downtrend for quite some time, and less Jerome Powell pivots, or perhaps traders think that he is pivoted, the market still is going to favor US dollars.

- Furthermore, the interest rate differential still favors the US dollar in the bond market, which of course is a huge factor on currency markets.

Beyond all of that, there is quite a bit of concern when it comes to the global economy anyway, and that is pro-US dollar. This is because people will buy things like bonds in order to protect their trading capital. In other words, this is probably a one-way trade given enough time, but that does not mean that there will not be the occasional rally that we can take advantage of or that signs of exhaustion won’t be something that you should jump on. In fact, it’s not till we break above the 1.23 level at the bare minimum that I would consider looking to the upside in this market. Even then, we would have to break above the 200 Day EMA.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]