[ad_1]

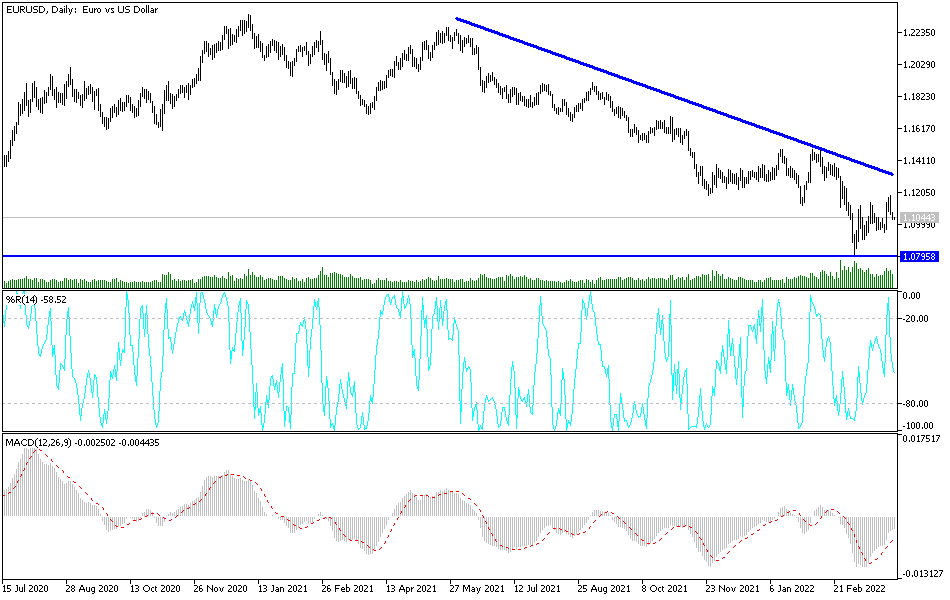

During last week’s trading, the price of the EUR/USD currency pair attempted to rebound to the upside. The pair is trying to compensate for its recent sharp losses, which brought it to the threshold of the psychological support level of 1.0800. The attempts to rebound have reached towards the resistance level of 1.1185, and closed the week’s trading stable around the 1.1040 level. Overall, the EUR/USD exchange rate attempted to reverse all the losses it has incurred since the Russian invasion of Ukraine before stopping near a set of technical resistances on the charts which could prevent the EUR’s path higher in the short term.

The Russian-Ukrainian conflict continues to dominate the outlook for the trajectory of the EUR/USD. Recently, German statements indicated that Russia has reversed its position. However, a Kremlin spokesman later said that the EU would need to get the Russian ruble in order to make the payments, and with the Kremlin neglecting to move forward immediately in an attempt to force European gas buyers to pay for their imports in rubles, further increases may have been avoided. destabilizing energy prices this week in what was likely to be a supportive development for the EUR.

Commenting on the performance of the euro-dollar Tim Riddell, macroeconomic analyst at Westpac based in London, said, “EUR/USD will remain weak, but support has picked up to the 1.1000-50 region.” USD from closing above 1.1175-90, the odds of a higher trading range will increase and increase the likelihood of retracements towards 1.1475-1.1500.”

Overall, rising inflation has prompted the ECB to prepare the markets for any and all forms of policy action in the coming quarters including a possible decision by the ECB to draw a line in a multi-year era of negative interest rates in the near future. We believe that optimists should realize that there are still reasons to contain the strength of the EUR. The European consumer is still facing a crisis of confidence and energy prices are well above normal levels. In macro terms, there is more to be priced in at the Fed at the expense of the ECB, the eurozone’s trade deficit is likely to widen, and the euro’s FX positions are not short-lived. This is why we expect the EUR to remain under pressure in April.

So far, forex analysts are still warning that there is still a risk of the EUR/USD falling to a multi-year low near 1.08 over the coming months, although they also reiterated their expectation of the single currency recovering to 1.14 by the end of the day. general.

Much of this forecast derives from the expectation that projected increases in US inflation may lead to the Fed moving faster to raise interest rates this year than exceptionally “hard” financial markets have been willing to tolerate. With inflation likely to prompt the European Central Bank to take action, the Euro is likely to be sensitive to the bloc’s inflation numbers especially with the European energy market being hit hard by the Russian war.

I still prefer to sell the EUR/USD from every bullish level as long as the Russo-Ukrainian war continues. The current rebound attempts for the currency pair may not exceed the resistance levels 1.1120 and 1.1200. On the other hand, according to the performance on the daily chart, the decline of the EUR/USD towards the support at 1.0950 will be important to the expectations of the psychological support at 1.0800.

[ad_2]